US Cellular 2008 Annual Report Download - page 42

Download and view the complete annual report

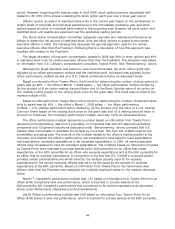

Please find page 42 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.incentive award component of such officer’s compensation because they consider outstanding equity

awards to represent compensation for past services.

Performance targets are intended to promote growth without encouraging officers to take

unnecessary and excessive risks that might threaten the value of U.S. Cellular. U.S. Cellular does not

have incentive plans pursuant to which officers become entitled to compensation as a result of the

achievement of a certain level of performance regardless of the risk undertaken. Instead, all

compensation is discretionary and, as a result, could be reduced or not awarded if an officer caused

U.S. Cellular to undertake unauthorized risk. In any event, U.S. Cellular believes that its controls and

monitoring would not permit officers to undertake unauthorized risk.

Benchmarking

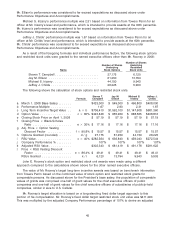

U.S. Cellular engages in benchmarking using surveys from Towers Perrin as described below.

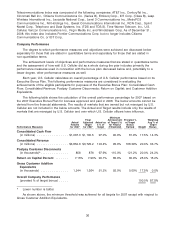

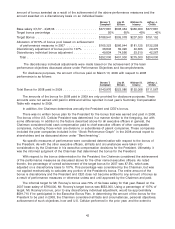

For annual cash compensation for the named executive officers other than the President and CEO,

Towers Perrin completed a job specific market pay analysis of U.S. Cellular’s executive officers base pay.

Executive officer positions were compared and matched to survey positions based on current role

responsibilities. The source of market data was the 2007 Towers Perrin Executive Compensation

Database. Competitive cash compensation data (base salaries) are from general industry (not industry

specific), and represent data for stand-alone companies of U.S. Cellular’s revenue size. Competitive pay

levels were determined through regression analysis, a statistical technique that considers the relationship

between revenue responsibility and compensation. U.S. Cellular’s projected revenues of $4.0 billion were

used for executive officer positions.

In addition, for the 2008 annual equity compensation awards, market benchmark data was obtained

from the Towers Perrin 2007 Compensation Data Bank Executive Compensation Database. The database

contained 429 companies that represented a diverse range of companies across all industries, including

companies from the telecommunications, electronics, manufacturing and consumer products sectors. For

comparison purposes, Towers Perrin provided market benchmark data based on a blended average

basis with 67% of the total based on telecommunications industry data and 33% based on general

industry data contained in the database. In addition, the benchmark data provided was based on only

those companies that had approximate annual revenues in the $3 billion to $6 billion revenue range. This

database was used to benchmark the equity compensation awards to the named executive officers, and

also for the annual cash compensation of the President and CEO of U.S. Cellular.

U.S. Cellular believes that the Towers Perrin databases provide a reasonably accurate reflection of

the competitive market for annual cash compensation and long-term equity incentives necessary to

compensate and retain current executives and attract future executives to positions at U.S. Cellular. In

addition, U.S. Cellular believes this methodology is more statistically valid than solely benchmarking

these elements of compensation to the peer group of companies used for calculating the Stock

Performance Graph in the Annual Report to Shareholders.

U.S. Cellular reviews or considers this broad-based third-party survey for only general purposes,

including to obtain a general understanding of current compensation practices. U.S. Cellular, the

Chairman and the Stock Option Compensation Committee rely upon and consider to be material only

the aggregated survey data prepared by Towers Perrin. The identities of the individual companies

included in the survey are not considered in connection with any individual compensation decisions

because this information is not considered to be material.

U.S. Cellular also considers the companies in the peer group index included in the ‘‘Stock

Performance Graph’’ that is included in the U.S. Cellular annual report to shareholders, as discussed

below, as well as other companies in the telecommunications industry and other industries, to the extent

considered appropriate, based on similar size, function, geography or otherwise. This information is used

to generally understand the market for general compensation arrangements for executives, but is not

used for benchmarking purposes.

U.S. Cellular selected the Dow Jones U.S. Telecommunications Index, a published industry index, for

purposes of the performance graph in 2007 and 2008. As of December 31, 2007, the Dow Jones U.S.

35