US Cellular 2008 Annual Report Download - page 75

Download and view the complete annual report

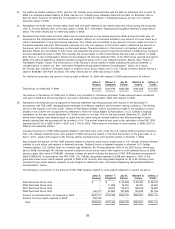

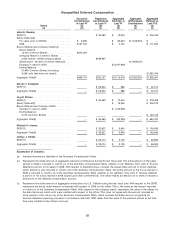

Please find page 75 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(c) Represents the aggregate dollar value realized upon exercise of stock options, based on the difference between the market

price of the underlying securities at exercise and the exercise or base price of the stock options.

(d) Represents the number of shares of stock that have vested. This includes restricted stock and bonus plan company-match

phantom stock units.

(e) Represents the aggregate dollar value realized upon vesting of stock, calculated by multiplying the number of shares of stock

or units by the market value (closing price) of the underlying shares on the vesting date.

Footnotes:

(1) Pursuant to John E. Rooney’s employment letter agreement, stock options and restricted stock units awarded to Mr. Rooney

on April 1, 2008 vested on October 1, 2008. The stock price used to calculate the value realized on vesting of the restricted

stock units was the closing price of U.S. Cellular Common Shares of $47.50 on October 1, 2008.

(2) Such restricted stock units became vested on March 31, 2008. The stock price used to calculate the value realized on vesting

was the closing price of U.S. Cellular Common Shares of $55.00 on March 31, 2008.

(3) Pursuant to U.S. Cellular’s 2005 Long-Term Incentive Plan, the bonus plan company-match phantom stock units vest one-third

on each of the first three anniversaries of the last day of the year for which the applicable bonus is payable, provided that the

officer is an employee of U.S. Cellular or an affiliate on such date. The stock price used to calculate the value on vesting was

the closing price of U.S. Cellular Common Shares of $43.24 on December 31, 2008, the last trading day in 2008. See

‘‘Information Regarding Nonqualified Deferred Compensation’’ below.

(4) All stock option exercises by John E. Rooney were made pursuant to a plan under SEC Rule 10b5-1.

(5) The exercise price with respect to such stock options was paid by allowing U.S. Cellular to withhold U.S. Cellular Common

Shares having a value equal to the aggregate exercise price, and taxes were paid by allowing U.S. Cellular to withhold U.S.

Cellular Common Shares having a value equal to the tax withholding amount.

(6) See the Outstanding Equity Awards at Fiscal Year-End Table above for a description of the stock options that continued to be

held by the named executive officers at December 31, 2008. In addition, the following is a description of stock options that

had been fully exercised as of December 31, 2008 by the named executive officers:

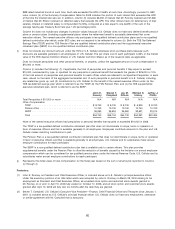

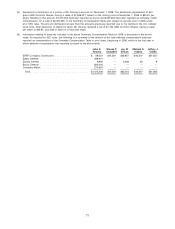

The 2004 Options were scheduled to become exercisable in annual increments of 25% on March 31 of each year beginning

in 2005 and ending in 2008 (except that all stock options became fully exercisable on October 10, 2006 with respect to

Mr. Rooney), and were exercisable until March 31, 2014 at an exercise price of $38.65.

The 2003 Options were scheduled to become exercisable in annual increments of 25% on March 31 of each year beginning

in 2004 and ending in 2007 (except that all stock options became fully exercisable on October 10, 2006 with respect to

Mr. Rooney), and were exercisable until April 21, 2013 at an exercise price of $24.47 for Mr. Rooney, and are exercisable until

March 31, 2013 at an exercise price of $23.61 for the other executive officers.

The 2002 Options were scheduled to become exercisable in annual increments of 25% on March 31 of each year beginning

in 2003 and ending in 2006, and were exercisable until March 31, 2012 at an exercise price of $41.00.

Information Regarding Pension Benefits

U.S. Cellular executive officers are covered by a ‘‘defined contribution’’ tax-deferred savings plan, a

‘‘defined contribution’’ pension plan and a related supplemental plan, as discussed above. The company

contributions for each of the named executive officers under these plans is disclosed in column (i), ‘‘All

Other Compensation,’’ of the Summary Compensation Table. However, U.S. Cellular does not have any

‘‘defined benefit’’ pension plans (including supplemental plans). The named executive officers only

participate in tax-qualified defined contribution plans and a non-qualified defined contribution plan. Both

the TDS Tax-Deferred Savings Plan (TDSP) and the TDS Pension Plan are qualified defined contribution

plans and the supplemental executive retirement plan (SERP) is a non-qualified defined contribution plan.

Accordingly, the Pension Benefits table provided by SEC rules is not applicable.

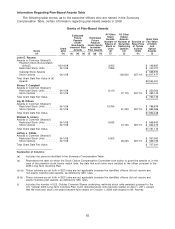

Information Regarding Nonqualified Deferred Compensation

The following table shows, as to the executive officers who are named in the Summary

Compensation Table, certain information regarding nonqualified deferred compensation for the year

ended and as of December 31, 2008.

68