US Cellular 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BBB rated industrial bonds at such time. Such rate exceeded the AFR of 5.68% at such time. Accordingly, pursuant to SEC

rules, column (h) of the Summary Compensation Table for 2008 includes the portion of such interest that exceeded the AFR

at the time the interest rate was set. In addition, column (h) includes $6,002 of interest that Mr. Rooney received and $1,308

of interest that Mr. Ellison received on deferred salary that exceeds the AFR. The other officers have not deferred any of their

salaries. Interest on deferred salary is compounded monthly, computed at a rate equal to one-twelfth of the sum of the

average twenty-year Treasury Bond rate plus 1.25 percentage points.

Column (h) does not include any changes in pension values because U.S. Cellular does not have any defined benefit pension

plans or pension plans (including supplemental plans) where the retirement benefit is actuarially determined that cover

executive officers. The named executive officers only participate in tax-qualified defined contribution plans and a non-qualified

defined contribution plan which, under SEC rules, are not required to be reflected in column (h). Both the TDS Tax-Deferred

Savings Plan (TDSP) and the TDS Pension Plan are qualified defined contribution plans and the supplemental executive

retirement plan (SERP) is a non-qualified defined contribution plan.

(i) Does not include any discount amount under the TDS or U.S. Cellular employee stock purchase plans because such

discounts are available generally to all employees of U.S. Cellular. The per share cost to each participant is 85% of the market

value of the TDS Special Common Shares or U.S. Cellular Common Shares as of the issuance date, as applicable.

Does not include perquisites and other personal benefits, or property, unless the aggregate amount of such compensation is

$10,000 or more.

Column (i) includes the following: (1) if applicable, the total of perquisites and personal benefits if they equal or exceed

$10,000, summarized by type, or specified for any perquisite or personal benefit that exceeds the greater of $25,000 or 10%

of the total amount of perquisites and personal benefits for each officer, which are referred to as Specified Perquisites, in each

case, valued on the basis of the aggregate incremental cost of such perquisite or personal benefit to U.S. Cellular, including

any related tax gross up, and (2) contributions by U.S. Cellular for the benefit of the named executive officer under (a) the

TDS tax-deferred savings plan which is referred to as the TDSP, (b) the TDS Pension Plan, and (c) the TDS supplemental

executive retirement plan, which is referred to as the SERP:

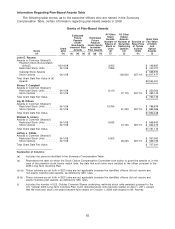

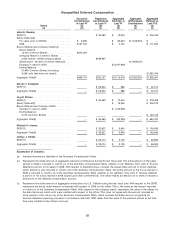

John E. Steven T. Jay M. Michael S. Jeffrey J.

Rooney Campbell Ellison Irizarry Childs

Total Perquisites if $10,000 or more ................ N/A N/A N/A N/A N/A

Other Compensation

TDSP .................................. $8,740 $ 8,740 $ 8,740 $ 6,900 $ 8,740

Pension Plan ............................. 10,740 10,740 10,740 10,740 10,740

SERP .................................. 35,260 26,624 35,260 32,621 23,014

Total .................................. $54,740 $46,104 $54,740 $50,261 $42,494

None of the named executive officers had perquisites or personal benefits that equaled or exceeded $10,000 in 2008.

The TDSP is a tax-qualified defined contribution retirement plan that does not discriminate in scope, terms or operation in

favor of executive officers and that is available generally to all employees. Employees contribute amounts to the plan and U.S.

Cellular makes matching contributions in part.

The Pension Plan is a tax-qualified defined contribution retirement plan that does not discriminate in scope, terms or operation

in favor of executive officers and that is available generally to all employees. U.S. Cellular and its subsidiaries make annual

employer contributions for each participant.

The SERP is a non-qualified defined contribution plan that is available only to certain officers. This plan provides

supplemental benefits under the Pension Plan to offset the reduction of benefits caused by the limitation on annual employee

compensation which can be considered for tax qualified pension plans under the Internal Revenue Code. U.S. Cellular and its

subsidiaries make annual employer contributions for each participant.

(j) Represents the dollar value of total compensation for the fiscal year based on the sum of all amounts reported in columns

(c) through (i).

Footnotes:

(1) John E. Rooney, as President and Chief Executive Officer, is included above as U.S. Cellular’s principal executive officer.

Under the executory portions of an offer letter which was accepted by John E. Rooney on March 28, 2000 relating to his

employment as President and Chief Executive Officer, all unvested stock option and restricted stock awards granted to

Mr. Rooney on or prior to April 10, 2006 fully vested on October 10, 2006, and all stock option and restricted stock awards

granted after April 10, 2006 will fully vest six months after the date they are granted.

(2) Steven T. Campbell, U.S. Cellular’s Executive Vice President—Finance, Chief Financial Officer and Treasurer since January 1,

2007, is included above as U.S. Cellular’s principal financial officer. U.S. Cellular does not have any employment, severance

or similar agreement with Mr. Campbell that is executory.

60