US Cellular 2008 Annual Report Download - page 62

Download and view the complete annual report

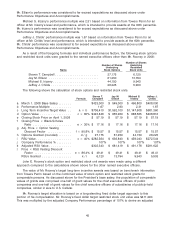

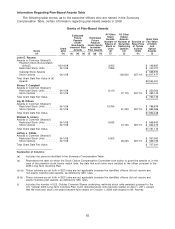

Please find page 62 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table. SEC rules do not require the Summary Compensation Table to include earnings or other amounts

with respect to tax-qualified defined contribution plans.

Under the TDS Pension Plan, vesting is not accelerated upon a change in control or other

termination event. The vested portion of an employee’s account becomes payable following the

employee’s termination of employment as (a) an annuity or (b) a lump sum payment. This plan does not

discriminate in scope, terms, or operation in favor of executive officers and is available generally to all

employees, and benefits are not enhanced upon any termination or change in control. Accordingly, no

amounts are reported in the below table of Potential Payments upon Termination or Change in Control.

Health and Welfare Benefits

TDS also provides customary health and welfare and similar plans for the employees of TDS and its

subsidiaries, including U.S. Cellular. These group life, health, hospitalization, disability and/or medical

reimbursement plans do not discriminate in scope, terms or operation, in favor of executive officers and

are available generally to all employees, and benefits are not enhanced upon any termination or change

in control. Accordingly, no amounts are reported in the below table of Potential Payments upon

Termination or Change in Control.

Impact of Accounting and Tax Treatments of Particular Forms of Compensation

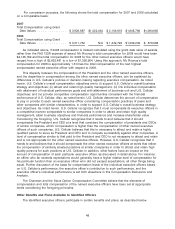

The Chairman and the Stock Option Compensation Committee consider the accounting and tax

treatments of particular forms of compensation. Accounting treatments do not significantly impact the

determinations of the appropriate compensation. The Chairman and the Stock Option Compensation

Committee consider the accounting treatments primarily to be informed and to confirm that company

personnel understand and recognize the appropriate accounting that will be required with respect to

compensation decisions.

U.S. Cellular places more significance on the tax treatments of particular forms of compensation,

because these may involve actual cash expense to the company or the executive. One objective of U.S.

Cellular is to maximize tax benefits to the company and executives to the extent feasible within the

overall goals of the compensation policy discussed above. In particular, one consideration is the effect of

Section 162(m) of the Internal Revenue Code.

Subject to certain exceptions, Section 162(m) of the Internal Revenue Code provides a one million

dollar annual limit on the amount that a publicly held corporation is allowed to deduct as compensation

paid to each of the corporation’s principal executive officer and the corporation’s other three most highly

compensated officers, exclusive of the principal executive officer and principal financial officer. U.S.

Cellular does not believe that the one million dollar deduction limitation currently has or should have in

the near future a material adverse effect on U.S. Cellular’s financial condition, results of operations or

cash flows. If the one million dollar deduction limitation is expected to have a material adverse effect on

U.S. Cellular in the future, U.S. Cellular will consider ways to maximize the deductibility of executive

compensation, while retaining the discretion U.S. Cellular deems necessary to compensate executive

officers in a manner commensurate with performance and the competitive environment for executive

talent.

U.S. Cellular does not have any arrangements with its executive officers pursuant to which it has

agreed to ‘‘gross-up’’ payments due to taxes or to otherwise reimburse officers for the payment of taxes,

except with respect to certain perquisites.

Financial Restatement

Depending on the facts and circumstances, U.S. Cellular may seek to adjust or recover awards or

payments if the relevant U.S. Cellular performance measures upon which they are based are restated or

otherwise adjusted in a manner that would reduce the size of an award or payment.

55