US Cellular 2008 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

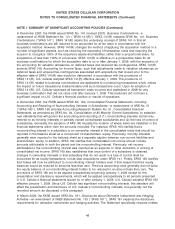

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations—a

replacement of FASB Statement No. 141 (‘‘SFAS 141(R)’’). SFAS 141(R) replaces SFAS No. 141, Business

Combinations (‘‘SFAS 141’’). SFAS 141(R) retains the underlying concept of SFAS 141 in that all

business combinations are still required to be accounted for at fair value in accordance with the

acquisition method. However, SFAS 141(R) changes the method of applying the acquisition method in a

number of significant aspects, such as requiring the expensing of transaction costs and requiring the

acquiror to recognize 100% of the acquiree’s assets and liabilities, rather than a proportional share, for

acquisitions of less than 100% of a business. SFAS 141(R) is effective on a prospective basis for all

business combinations for which the acquisition date is on or after January 1, 2009, with the exception of

the accounting for valuation allowances on deferred taxes and acquired tax contingencies. SFAS 141(R)

amends SFAS 109, Accounting for Income Taxes, such that adjustments made to valuation allowances on

deferred taxes and acquired tax contingencies associated with acquisitions that closed prior to the

effective date of SFAS 141(R) also would be determined in accordance with the provisions of

SFAS 141(R). U.S. Cellular adopted SFAS 141(R) effective January 1, 2009. The provisions of

SFAS 141(R) related to business combinations are applicable to nonrecurring transactions which makes

the impact on future transactions indeterminable until such transactions occur. Upon its adoption of

SFAS 141(R), U.S. Cellular expensed all transaction costs incurred and capitalized in 2008 for any

business combination that did not close until after January 1, 2009. This treatment did not have a

significant impact on U.S. Cellular’s financial position or results of operations.

In December 2007, the FASB issued SFAS No. 160, Consolidated Financial Statements, Including

Accounting and Reporting of Noncontrolling Interests in Subsidiaries—a replacement of ARB No. 51

(‘‘SFAS 160’’). SFAS 160 amends Accounting Research Bulletin No. 51, Consolidated Financial

Statements, as amended by SFAS No. 94, Consolidation of All Majority Owned Subsidiaries, to establish

new standards that will govern the accounting and reporting of (1) noncontrolling interests (commonly

referred to as minority interests) in partially owned consolidated subsidiaries and (2) the loss of control of

subsidiaries. Generally, the adoption of FAS 160 impacts the location of where items are classified in the

financial statements rather than the amounts recorded. For instance, SFAS 160 clarifies that a

noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be

reported in the balance sheet as a component of shareholders’ equity. Previously, minority interests

generally were reported in the balance sheet as a separate caption between non-current liabilities and

shareholders’ equity. In addition, SFAS 160 clarifies that consolidated net income should include

amounts attributable to both the parent and the noncontrolling interest. Previously, net income

attributable to the noncontrolling interest was reported as an expense or other deduction in arriving at

consolidated net income. SFAS 160 also establishes that once control of a subsidiary is obtained,

changes in ownership interests in that subsidiary that do not result in a loss of control shall be

accounted for as equity transactions, not as step acquisitions under SFAS 141. Finally, SFAS 160 clarifies

that losses will now be attributed to noncontrolling interest holders even if that means that their equity

balances would be reduced to amounts less than zero. Previous accounting rules generally did not allow

the equity balance of a noncontrolling interest holder to be reduced to an amount less than zero. The

provisions of SFAS 160 are to be applied prospectively beginning January 1, 2009 except for the

presentation and disclosure requirements, which will be applied retrospectively to all periods presented

in U.S. Cellular’s financial statements issued on or after January 1, 2009. U.S. Cellular adopted SFAS 160

effective January 1, 2009. Since U.S. Cellular has significant noncontrolling interests, this standard will

affect the presentation and disclosure of U.S. Cellular’s noncontrolling interests, but generally not the

recorded amount, as discussed in this paragraph.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging

Activities—an amendment of FASB Statement No. 133 (‘‘SFAS 161’’). SFAS 161 expands the disclosure

requirements for derivative instruments and hedging activities. The Statement specifically requires entities

48