US Cellular 2008 Annual Report Download - page 82

Download and view the complete annual report

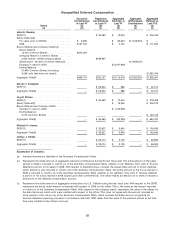

Please find page 82 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(d) Represents the maximum potential value of accelerated bonus match units assuming that a

Triggering Event took place on December 31, 2008 and that the price per share of the registrant’s

securities is the closing market price as of December 31, 2008, the last trading day in 2008. The

stock price used was the closing price of U.S. Cellular Common Shares of $43.24 on December 31,

2008.

(e) There were no other potential payments upon a termination or change in control as of December 31,

2008.

(f) Represents the total of columns (b) through (e).

Although U.S. Cellular has attempted to make a reasonable estimate (or a reasonable estimated

range of amounts) applicable to the payment or benefit based on the disclosed material

assumptions, the calculation of the foregoing represents forward-looking statements that involve

risks, uncertainties and other factors that may cause actual results to be significantly different from

the amounts expressed or implied by such forward-looking statements. Such risks, uncertainties and

other factors include those set forth under ‘‘Risk Factors’’ in U.S. Cellular’s Form 10-K for the year

ended December 31, 2008.

Perquisites and other personal benefits or property payable upon termination or change in control

are excluded only if the aggregate amount of such compensation will be less than $10,000. A

perquisite or personal benefit is specifically identified only if it exceeds the greater of $25,000 or 10%

of the total amount of perquisites and personal benefits for an officer. Any perquisite or personal

benefit is valued on the basis of the aggregate incremental cost of such perquisite or personal

benefit to U.S. Cellular.

No information is provided with respect to contracts, agreements, plans or arrangements to the

extent they do not discriminate in scope, terms or operation, in favor of executive officers of U.S.

Cellular and that are available generally to all employees.

Footnotes:

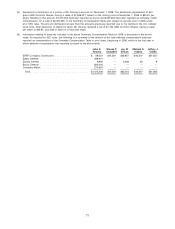

(1) U.S. Cellular has certain arrangements with John E. Rooney relating to vesting of stock options and

restricted stock units. Reference is made to U.S. Cellular’s Form 8-K dated March 26, 2000 for

further information. All unvested stock options and restricted stock units granted on or prior to

April 10, 2006 became vested as of October 10, 2006, and all stock options and restricted stock

units granted after April 10, 2006 vest six months after the date of grant, as discussed above.

Accordingly, Mr. Rooney would have no further benefits or acceleration as a result of termination or

Change in Control, except with respect to bonus stock match units as set forth in the above table.

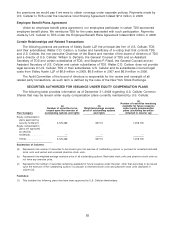

(2) The following table shows the calculation of the difference between the exercise price of such stock

options and such year end stock price. Because the exercise price of each of the USM options

75