US Cellular 2008 Annual Report Download - page 57

Download and view the complete annual report

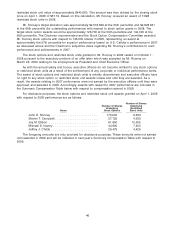

Please find page 57 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.U.S. Cellular 2005 Long-Term Incentive Plan

Long-term compensation awards under the U.S. Cellular 2005 Long-Term Incentive Plan were

discussed above in this Compensation Discussion and Analysis. This plan was amended by the U.S.

Cellular board of directors on March 17, 2009, subject to shareholder approval, to increase the number

of shares that may be issued pursuant to such plan. See Proposal 3 above. The following provides

certain additional information relating to deferred bonus, restricted stock units and stock options.

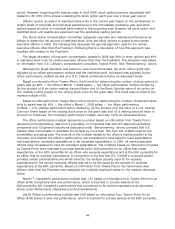

Pursuant to the U.S. Cellular 2005 Long-Term Incentive Plan, each officer may elect to defer all or a

portion of his annual bonus. U.S. Cellular will allocate a match award to the employee’s deferred

compensation account in an amount equal to the sum of (i) 25% of the deferred bonus amount which is

not in excess of one-half of the employee’s gross bonus for the year and (ii) 331⁄3% of the deferred

bonus amount which is in excess of one-half of the employee’s gross bonus for the year. The matched

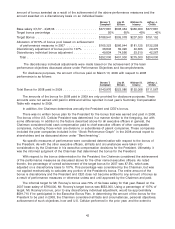

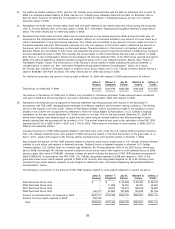

stock units vest ratably at a rate of one-third per year over three years. Column (e), ‘‘Stock Awards,’’ of

the below Summary Compensation Table includes the dollar amount recognized for financial statement

reporting purposes with respect to the fiscal year in accordance with FAS 123R.

Restricted stock units may be granted under the U.S. Cellular 2005 Long-Term Incentive Plan.

Column (e), ‘‘Stock Awards,’’ of the Summary Compensation Table includes the dollar amount

recognized for financial statement reporting purposes with respect to the fiscal year in accordance with

FAS 123R, disregarding the estimate of forfeitures related to service-based vesting conditions.

Stock options may be granted under the U.S. Cellular 2005 Long-Term Incentive Plan. Column (f),

‘‘Option Awards,’’ of the Summary Compensation Table includes the dollar amount recognized for

financial statement reporting purposes with respect to the fiscal year in accordance with FAS 123R,

disregarding the estimate of forfeitures related to service-based vesting conditions.

The phantom stock units, restricted stock units and stock options are not credited with any

dividends because U.S. Cellular does not currently pay dividends.

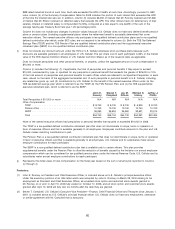

The U.S. Cellular 2005 Long-Term Incentive Plan and related stock option, restricted stock unit and

deferred bonus award agreements provide various rights upon termination and/or change in control, as

summarized below.

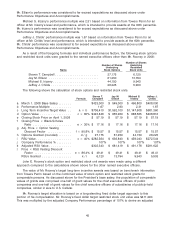

Stock Options. The U.S. Cellular stock option agreements with named executive officers provide as

follows:

Disability. If the officer’s employment terminates by reason of disability (a total physical disability

which, in the Stock Option Compensation Committee’s judgment, prevents the officer from performing

substantially such officer’s employment duties and responsibilities for a continuous period of at least six

months), then the stock option will be exercisable only to the extent it is exercisable on the effective date

of the officer’s termination of employment or service and after such date may be exercised by the stock

option holder (or the holder’s legal representative) for a period of 12 months after the effective date of

the officer’s termination of employment or service, or until the stock option’s expiration date, whichever

period is shorter.

Special Retirement. If the officer’s employment terminates by reason of Special Retirement

(termination of employment or service on or after the later of (i) the officer’s attainment of age 62 and

(ii) the officer’s early retirement date or normal retirement date under the TDS Pension Plan), then the

stock option immediately will become exercisable in full and after such date may be exercised by the

stock option holder (or the holder’s legal representative) for a period of 12 months after the effective date

of the Special Retirement, or until the stock option’s expiration date, whichever period is shorter.

However, effective for stock options granted in April 2008, the option will become 100% exercisable only

if at the time of termination, the officer has attained age 66 and the termination occurs subsequent to the

year of grant.

Retirement. If the officer’s employment terminates by reason of Retirement (termination of

employment or service on or after the officer’s attainment of age 65 that does not satisfy the definition of

‘‘Special Retirement,’’ as set forth above), then the stock option immediately will become exercisable in

full and after such date may be exercised by the holder (or the holder’s legal representative) for a period

50