US Cellular 2008 Annual Report Download - page 88

Download and view the complete annual report

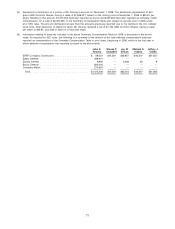

Please find page 88 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.determined to be attributable to the income, deductions or credits of U.S. Cellular, such deficiency or

refund will be payable by or to us. Under the tax allocation agreement, U.S. Cellular paid $102.4 million

to TDS for federal income taxes in 2008.

If we cease to be a member of the TDS affiliated group, and for a subsequent year U.S. Cellular and

its subsidiaries are required to pay a greater amount of Federal income tax than they would have paid if

they had not been members of the TDS affiliated group after June 30, 1987, TDS will reimburse us for

the excess amount of tax, without interest. In determining the amount of reimbursement, any profits or

losses from new business activities acquired by us or our subsidiaries after we leave the TDS affiliated

group will be disregarded. No reimbursement will be required if at any time in the future U.S. Cellular

becomes a member of another affiliated group in which U.S. Cellular is not the common parent or fewer

than 500,000 U.S. Cellular Series A Common Shares are outstanding. In addition, reimbursement will not

be required on account of the income of any subsidiary of U.S. Cellular if more than 50% of the voting

power of such subsidiary is held by a person or group other than a person or group owning more than

50% of the voting power of TDS.

Rules similar to those described above will be applied to any state or local franchise or income tax

liabilities to which TDS and U.S. Cellular and its subsidiaries are subject and which are required to be

determined on a unitary, combined or consolidated basis. Under such rules, U.S. Cellular paid a net

amount of $7.0 million to TDS for such taxes in 2008.

Cash Management Agreement

From time to time we deposit our excess cash with TDS for investment under TDS’ cash

management program pursuant to the terms of a cash management agreement. Such deposits are

available to us on demand and bear interest each month at the 30-day commercial paper rate reported

in The Wall Street Journal on the last business day of the preceding month plus 1⁄4%, or such higher rate

as TDS may in its discretion offer on such demand deposits. We may elect to place funds for a longer

period than on demand in which event, if such funds are placed with TDS, they will bear interest at the

commercial paper rate for investments of similar maturity plus 1⁄4%, or at such higher rate as TDS may in

its discretion offer on such investments.

Intercompany Agreement

In order to provide for certain transactions and relationships between the parties, U.S. Cellular and

TDS have agreed under an intercompany agreement, among other things, as follows:

Services. U.S. Cellular and TDS make available to each other from time to time services relating to

operations, marketing, human resources, accounting, customer services, customer billing, finance, and

general administration, among others. Unless otherwise provided by written agreement, services

provided by TDS or any of its subsidiaries are charged and paid for in conformity with the customary

practices of TDS for charging TDS’ non-telephone company subsidiaries. Payments by us to TDS for

such services totaled $86.7 million in 2008. For services provided to TDS, we receive payment for the

salaries of our employees and agents assigned to render such services (plus 40% of the cost of such

salaries in respect of overhead) for the time spent rendering such services, plus out-of-pocket expenses.

Payments by TDS to us for such services were nominal in 2008.

Equipment and Materials. We purchase materials and equipment from TDS and its subsidiaries on

the same basis as materials and equipment are purchased by any TDS affiliate from another TDS

affiliate. Purchases by us from TDS affiliates totaled $19.5 million in 2008.

Accountants and Legal Counsel. We have agreed to engage the firm of independent registered

public accountants selected by TDS for purposes of auditing our financial statements, including the

financial statements of our direct and indirect subsidiaries, and providing certain other services. We have

also agreed that, in any case where legal counsel is to be engaged to represent the parties for any

purpose, TDS has the right to select the counsel to be engaged, which may be the same counsel

selected to represent TDS unless such counsel deems there to be a conflict. If we use the same counsel

as TDS, each of us and TDS is responsible for the portion of the fees and expenses of such counsel

determined by such counsel to be allocable to each.

81