US Cellular 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

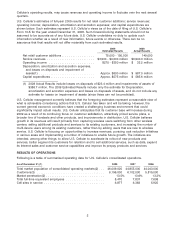

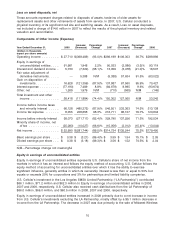

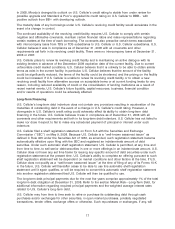

Interest expense

Interest expense is summarized by related debt instrument in the following table:

Year Ended December 31, 2008 2007 2006

(Dollars in thousands)

6.7% senior notes .................................. $37,085 $37,084 $37,080

7.5% senior notes .................................. 25,113 25,113 25,113

8.75% senior notes ................................. 11,383 11,380 11,383

Forward contracts(1) ................................ — 3,514 9,067

Revolving credit facility ............................... 3,061 4,967 8,337

Other ........................................... 548 2,621 2,694

Total interest expense ................................ $77,190 $84,679 $93,674

(1) In May 2002, U.S. Cellular entered into the forward contracts relating to its investment in

Vodafone ADRs. Taken together, the forward contracts allowed U.S. Cellular to borrow an

aggregate of $159.9 million against the Vodafone ADRs. The forward contracts bore interest,

payable quarterly, at the London InterBank Offered Rate (‘‘LIBOR’’) plus 50 basis points.

The decreases in Interest expense in 2008 and 2007 were due primarily to lower average revolving credit

facility balances and U.S. Cellular settling its variable prepaid forward contracts in May 2007.

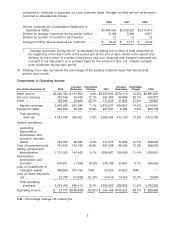

Income tax expense

The effective tax rate on Income before income taxes and minority interest (‘‘pre-tax income’’) was

12.2%, 39.7% and 38.5% for 2008, 2007, and 2006, respectively.

The 2008 income tax expense includes a tax benefit of $149.6 million related to the $386.7 million loss

on impairment of intangible assets. As a result of this impairment loss, the dollar amount of U.S.

Cellular’s pre-tax income and income taxes calculated at the statutory rate was substantially reduced,

which magnifies the dollar amount of other tax items in percentage terms. The 2008 state income tax

amount includes a $15.1 million benefit from the loss on impairment of intangible assets, a $7.6 million

benefit from a change in filing positions in certain states and a $2.5 million benefit from the resolution of

a prior period tax issue. Compared to 2007, the state tax rate also benefitted due to an increase of

$3.3 million in deferred tax valuation allowances in 2007 resulting from the restructuring of certain legal

entities for tax purposes that did not occur in 2008. Compared to 2007, the overall tax rate also

benefitted due to a $4.6 million one-time write-off in 2007 of deferred tax assets for certain partnerships

(which is reflected in minority share of income not included in the consolidated tax return), and the

resolution of other prior period tax issues.

The 2007 tax rate was higher than the 2006 tax rate due to the increase in deferred tax valuation

allowances and the one-time write-off of deferred tax assets noted above.

INFLATION

Management believes that inflation affects U.S. Cellular’s business to no greater or lesser extent than the

general economy.

RECENT ACCOUNTING PRONOUNCEMENTS

In general, recent accounting pronouncements did not have and are not expected to have a significant

effect on U.S. Cellular’s financial condition and results of operations, except that certain recent

accounting pronouncements will have a significant effect on how U.S. Cellular will account for future

acquisitions and how U.S. Cellular will present and disclose minority interests (to be redesignated as

non-controlling interests) in 2009 and subsequent years.

See Note 1—Summary of Significant Accounting Policies in the Notes to Consolidated Financial

Statements for information on recent accounting pronouncements.

12