US Cellular 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Cash distributions from unconsolidated entities increased by $9.0 million.

• Changes in assets and liabilities from operations other than accrued taxes increased the net cash

inflow by $51.0 million. Such assets and liabilities required cash of $43.8 million in 2007 and

$94.8 million in 2006. The majority of this net change was attributable to a decrease in the inventory

balance, reflecting a lower number of handsets on hand.

• Income taxes paid reduced the net cash inflow by $64.9 million in 2007 compared to 2006. Such taxes

were $212.6 million and $147.7 million in 2007 and 2006, respectively. The 2007 income taxes were

higher primarily due to the 2007 gain on the disposition of Vodafone ADRs and the settlement of the

related forward contracts, and higher 2007 operating income relative to 2006.

Cash Flows from Investing Activities

U.S. Cellular makes substantial investments each year to construct and upgrade modern high quality

wireless communications networks and facilities as a basis for creating long term value for shareholders.

In recent years, rapid changes in technology and new opportunities have required substantial

investments in revenue-enhancing and cost-reducing upgrades of U.S. Cellular’s networks. Cash flows

used for investing activities also represent cash required for the acquisition of wireless properties or

licenses. Proceeds from exchanges and divestiture transactions have provided funds in recent years

which have partially offset the cash requirements for investing activities; however, such sources cannot

be relied upon to provide continuing or regular sources of financing.

The primary purpose of U.S. Cellular’s construction and expansion expenditures is to provide for

customer and usage growth, to upgrade service and to take advantage of service-enhancing and

cost-reducing technological developments in order to maintain competitive services.

Cash used for property, plant and equipment and system development expenditures totaled

$585.6 million in 2008, $565.5 million in 2007 and $579.8 million in 2006. These expenditures were

financed primarily with internally generated cash and borrowings under U.S. Cellular’s revolving credit

facility. These expenditures were made to construct cell sites, increase capacity in existing cell sites and

switches, upgrade technology including the overlay of EVDO technology in certain markets, develop new

and enhance existing office systems, and construct new and remodel existing retail stores.

Cash required for acquisitions totaled $341.7 million in 2008, $21.5 million in 2007 and $145.7 million in

2006. U.S. Cellular’s acquisitions included primarily the purchase of interests in wireless markets and

wireless spectrum. The cash impact of 2008 acquisitions is summarized below.

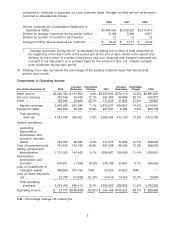

2008 Acquisitions Cash Payment(1)

(Dollars in millions)

Auction 73 Licenses(2) ................................... $300.5

Missouri Licenses ....................................... 19.6

North Carolina RSA 1 Partnership ........................... 6.9

Maine Licenses ........................................ 5.0

Other ............................................... 9.7

Total ................................................ $341.7

(1) Cash amounts paid for the acquisitions differ from the purchase price due to transaction

related expenses incurred, but not yet paid, as of December 31, 2008.

(2) King Street Wireless L.P., an entity in which a subsidiary of U.S. Cellular is a limited partner

with a 90% partnership interest, made these payments. U.S. Cellular loaned these funds to

the partnership and the general partner and made direct capital investments to fund the

auction payment.

Significant acquisitions in 2007 and 2006 included U.S. Cellular’s 2007 purchase of 100% of the

membership interests of Iowa 15 Wireless, LLC for approximately $18.3 million in cash and U.S.

Cellular’s $127.1 million cash payment in 2006 for 17 licenses awarded in the 2006 FCC Auction 66.

14