US Cellular 2008 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 13 NOTES PAYABLE (Continued)

The maturity date of any borrowings under U.S. Cellular’s revolving credit facility would accelerate in the

event of a change in control.

The continued availability of the revolving credit facility requires U.S. Cellular to comply with certain

negative and affirmative covenants, maintain certain financial ratios and make representations regarding

certain matters at the time of each borrowing. The covenants also prescribe certain terms associated

with intercompany loans from TDS or TDS subsidiaries to U.S. Cellular or U.S. Cellular subsidiaries. U.S.

Cellular believes it was in compliance as of December 31, 2008 with all covenants and other

requirements set forth in its revolving credit facility. There were no intercompany loans at December 31,

2008 or 2007.

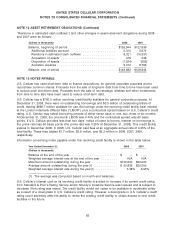

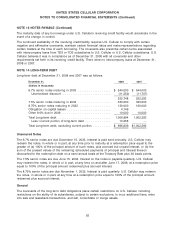

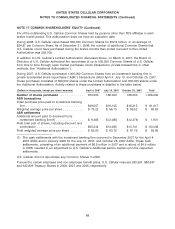

NOTE 14 LONG-TERM DEBT

Long-term debt at December 31, 2008 and 2007 was as follows:

December 31, 2008 2007

(Dollars in thousands)

6.7% senior notes maturing in 2033 .................. $ 544,000 $ 544,000

Unamortized discount ........................... (11,252) (11,707)

532,748 532,293

7.5% senior notes maturing in 2034 .................. 330,000 330,000

8.75% senior notes maturing in 2032 ................. 130,000 130,000

Obligation on capital leases ........................ 4,146 —

Other 9.0% due in 2009 ........................... 10,000 10,000

Total Long-term debt ............................. 1,006,894 1,002,293

Less: Current portion of long-term debt .............. 10,258 —

Total Long-term debt, excluding current portion .......... $ 996,636 $1,002,293

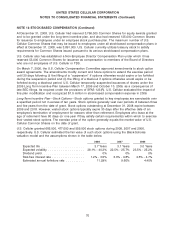

Unsecured Notes

The 6.7% senior notes are due December 15, 2033. Interest is paid semi-annually. U.S. Cellular may

redeem the notes, in whole or in part, at any time prior to maturity at a redemption price equal to the

greater of (a) 100% of the principal amount of such notes, plus accrued but unpaid interest, or (b) the

sum of the present values of the remaining scheduled payments of principal and interest thereon

discounted to the redemption date on a semi-annual basis at the Treasury Rate plus 30 basis points.

The 7.5% senior notes are due June 15, 2034. Interest on the notes is payable quarterly. U.S. Cellular

may redeem the notes, in whole or in part, at any time on and after June 17, 2009, at a redemption price

equal to 100% of the principal amount redeemed plus accrued interest.

The 8.75% senior notes are due November 1, 2032. Interest is paid quarterly. U.S. Cellular may redeem

the notes, in whole or in part, at any time at a redemption price equal to 100% of the principal amount

redeemed plus accrued interest.

General

The covenants of the long-term debt obligations place certain restrictions on U.S. Cellular, including

restrictions on the ability of its subsidiaries, subject to certain exclusions, to incur additional liens, enter

into sale and leaseback transactions, and sell, consolidate or merge assets.

63