US Cellular 2008 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

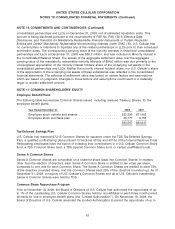

NOTE 16 COMMITMENTS AND CONTINGENCIES (Continued)

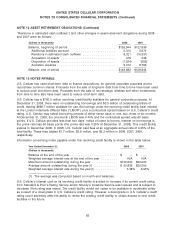

consolidated partnerships and LLCs on December 31, 2008, net of estimated liquidation costs. This

amount is being disclosed pursuant to the requirements of FSP No. FAS 150-3, Effective Date,

Disclosures, and Transition for Mandatorily Redeemable Financial Instruments of Certain Nonpublic

Entities and Certain Mandatorily Redeemable Noncontrolling Interests under SFAS 150. U.S. Cellular has

no current plans or intentions to liquidate any of the related partnerships or LLCs prior to their scheduled

termination dates. The corresponding carrying value of the minority interests in finite-lived consolidated

partnerships and LLCs at December 31, 2008 was $55.3 million, and was included in Minority interest in

the Consolidated Balance Sheet. The excess of the aggregate settlement value over the aggregate

carrying value of the mandatorily redeemable minority interests of $94.6 million was due primarily to the

unrecognized appreciation of the minority interest holders’ share of the underlying net assets in the

consolidated partnerships and LLCs. Neither the minority interest holders’ share, nor U.S. Cellular’s share

of the appreciation of the underlying net assets of these subsidiaries was reflected in the consolidated

financial statements. The estimate of settlement value was based on certain factors and assumptions

which are based on judgment. Changes in those factors and assumptions could result in a materially

larger or smaller settlement amount.

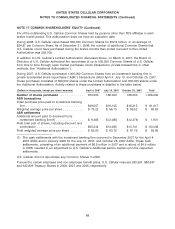

NOTE 17 COMMON SHAREHOLDERS’ EQUITY

Employee Benefit Plans

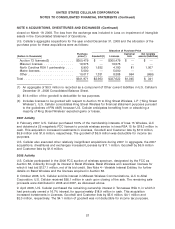

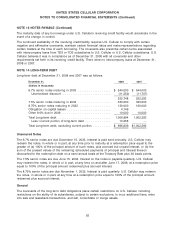

The following table summarizes Common Shares issued, including reissued Treasury Shares, for the

employee benefit plans:

Year Ended December 31, 2008 2007

Employee stock options and awards ...................... 253,390 871,493

Employee stock purchase plan .......................... 30,177 9,154

283,567 880,647

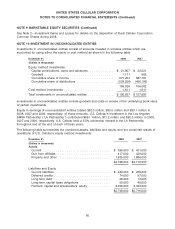

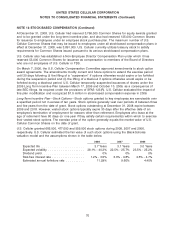

Tax-Deferred Savings Plan

U.S. Cellular has reserved 67,215 Common Shares for issuance under the TDS Tax-Deferred Savings

Plan, a qualified profit-sharing plan pursuant to Sections 401(a) and 401(k) of the Internal Revenue Code.

Participating employees have the option of investing their contributions in a U.S. Cellular Common Share

fund, a TDS Common Share fund, a TDS Special Common Share fund, or certain unaffiliated funds.

Series A Common Shares

Series A Common Shares are convertible on a share-for-share basis into Common Shares. In matters

other than the election of directors, each Series A Common Share is entitled to ten votes per share,

compared to one vote for each Common Share. The Series A Common Shares are entitled to elect 75%

of the directors (rounded down), and the Common Shares elect 25% of the directors (rounded up). As of

December 31, 2008, a majority of U.S. Cellular’s Common Shares and all of U.S. Cellular’s outstanding

Series A Common Shares were held by TDS.

Common Share Repurchase Program

Prior to November 18, 2008, the Board of Directors of U.S. Cellular had authorized the repurchase of up

to 1% of the outstanding U.S. Cellular Common Shares held by non-affiliates in each three month period,

primarily for use in employee benefit plans (the ‘‘Limited Authorization’’). On November 18, 2008, the

Board of Directors of U.S. Cellular amended the Limited Authorization to permit the repurchase of up to

67