US Cellular 2008 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

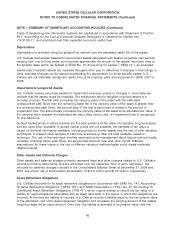

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

were not being utilized and, therefore, were not expected to generate cash flows from operating activities

in the foreseeable future, were considered separate units of accounting for purposes of impairment

testing. Subsequent to the second quarter 2008 licenses impairment testing, previously unutilized

licenses in one unit of accounting were deployed in one of the five units of accounting that represent

developed operating markets. As a result, U.S. Cellular’s impairment testing of licenses conducted in the

fourth quarter of 2008 was applied to eighteen units of accounting, thirteen of which represent areas that

are not being utilized.

For purposes of impairment testing of goodwill, U.S. Cellular prepares valuations of each of the five

reporting units. A discounted cash flow approach is used to value each of the reporting units, using

value drivers and risks specific to each individual geographic region. The cash flow estimates incorporate

assumptions that market participants would use in their estimates of fair value. Key assumptions made in

this process are the discount rate, estimated future cash flows, projected capital expenditures and

terminal value multiples.

For purposes of impairment testing of licenses, U.S. Cellular prepares valuations of each of the units of

accounting that represent developed operating markets using an excess earnings methodology. This

excess earnings methodology estimates the fair value of the units of accounting by measuring the future

cash flows of the license groups, reduced by charges for contributory assets such as working capital,

trademarks, existing subscribers, fixed assets, assembled workforce and goodwill. For units of

accounting which consist of licenses that are not being utilized, U.S. Cellular prepares estimates of fair

value by reference to fair market values indicated by recent auctions and market transactions where

available.

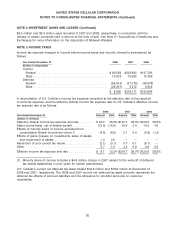

Investments in Unconsolidated Entities

Investments in unconsolidated entities consist of investments in which U.S. Cellular holds a

non-controlling ownership interest of 50% or less. U.S. Cellular follows the equity method of accounting

for such investments in which its ownership interest equals or exceeds 20% for corporations and equals

or exceeds 3% for partnerships and limited liability companies. The cost method of accounting is

followed for such investments in which U.S. Cellular’s ownership interest is less than 20% for

corporations and is less than 3% for partnerships and limited liability companies and for investments for

which U.S. Cellular does not have the ability to exercise significant influence.

For its equity method investments for which financial information is readily available, U.S. Cellular records

its equity in the earnings of the entity in the current period. For its equity method investments for which

financial information is not readily available, U.S. Cellular records its equity in the earnings of the entity

on a one quarter lag basis.

Property, Plant and Equipment

U.S. Cellular’s Property, plant and equipment is stated at the original cost of construction or purchase

including capitalized costs of certain taxes, payroll-related expenses, interest and estimated costs to

remove the assets.

Expenditures that enhance the productive capacity of assets in service or extend their useful lives are

capitalized and depreciated. Expenditures for maintenance and repairs of assets in service are charged

to System operations expense or Selling, general and administrative expense, as applicable. Retirements

and disposals of assets are recorded by removing the original cost of the asset (along with the related

accumulated depreciation) from plant in service and charging it, together with removal cost less any

salvage realized, to Loss on asset disposals, net.

42