US Cellular 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.period. However, beginning with awards made in April 2008, stock options become exercisable with

respect to 33 1/3% of the shares underlying the stock option each year over a three year period.

Officers receive an award of restricted stock units in the current year based on the achievement of

certain levels of corporate and individual performance in the immediately preceding year and stock

options based primarily on individual performance in the preceding year. However, all stock option and

restricted stock unit awards are expensed over the applicable vesting periods.

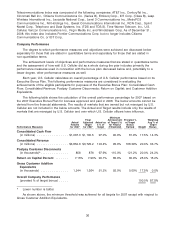

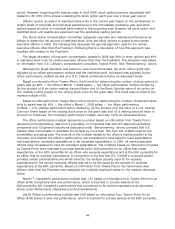

The Stock Option Compensation Committee measured corporate and individual performance as

follows to determine the amount of restricted stock units and stock options to award to the named

executive officers in 2008. The following first discusses the general approach used for the named

executive officers other than the President. Following that is a discussion of how this approach was

modified with respect to the President.

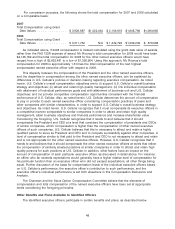

The target allocation of long-term compensation awards in 2008 was 60% in stock options and 40%

in restricted stock units for named executive officers other than the President. This allocation was based

on information from U.S. Cellular’s compensation consultant, Towers Perrin. See ‘‘Benchmarking’’ above.

Although the target allocation was based on such benchmark data, the stock option grant was

adjusted by an officer performance multiple and the restricted stock unit award was adjusted by the

officer performance multiple as well as a U.S. Cellular performance factor, as discussed below.

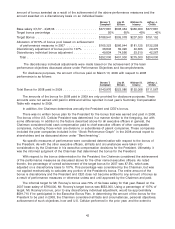

Based on information from Towers Perrin, the formula for determining the number of stock options to

award was (a) 60% the officer’s March 1, 2008 salary the officer performance multiple divided by

(b) the product of (i) an option vesting discount factor and (ii) the Black Scholes value of an option on

U.S. Cellular’s stock based on the closing stock price on the grant date. This result was rounded to the

nearest multiple of 25.

Based on information from Towers Perrin, the formula for determining the number of restricted stock

units to award was (a) 40% the officer’s March 1, 2008 salary the officer performance

multiple U.S. Cellular performance factor divided by (b) the product of (i) the value of a U.S. Cellular

Common Share based on the closing stock price on the grant date and (ii) a vesting discount factor to

account for forfeitures. The Company performance multiple used was 107% as discussed above.

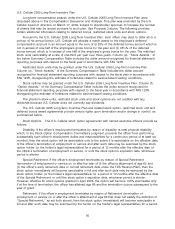

The officer performance multiple represents a number based on information from Towers Perrin

derived from benchmarking data from a population of companies that were 2/3 telecommunications

companies and 1/3 general industry as discussed under ‘‘Benchmarking’’ above, provided that U.S.

Cellular does not increase or decrease the multiple by more than 15% from the multiple used for the

immediately preceding year. The amount of this multiple related to the officer’s relative position in the

Company and whether the officer’s performance was considered to have failed to meet expectations,

met expectations, exceeded expectations or far exceeded expectations. In 2007, all named executive

officers were considered to have far exceeded expectations. The multiples based on information provided

by Towers Perrin were intended to provide awards at the 50th percentile for an officer that meets

expectations, at the 60th percentile for an officer who exceeds expectations and at the 65th percentile for

an officer that far exceeds expectations. In recognition of the fact that U.S. Cellular’s corporate parent

provides certain administrative and similar services, the multiple actually used for far exceeds

expectations for the named executive officers was set to be the same as the multiple for exceeds

expectations at the 60th percentile. Based on information from Towers Perrin, the named executive

officers other than the President were assigned the multiples disclosed below for the reasons disclosed

below.

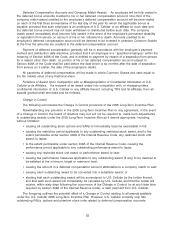

Steven T. Campbell’s performance multiple was 1.67 based on information from Towers Perrin for an

officer at Mr. Campbell’s level and performance, which is intended to provide awards at the

60th percentile. Mr. Campbell’s performance was considered to far exceed expectations as discussed

above under Performance Objectives and Accomplishments.

Jay M. Ellison’s performance multiple was 2.90 based on information from Towers Perrin for an

officer at Mr. Ellison’s level and performance, which is intended to provide awards at the 60th percentile.

44