US Cellular 2008 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

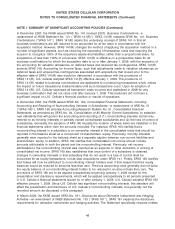

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

to provide enhanced disclosures addressing the following: (a) how and why an entity uses derivative

instruments, (b) how derivative instruments and related hedged items are accounted for under SFAS 133

and its related interpretations, and (c) how derivative instruments and related hedged items affect an

entity’s financial position, financial performance, and cash flows. U.S. Cellular adopted SFAS 161

effective January 1, 2009, and such adoption will have no impact on its financial statement disclosures.

In April 2008, the FASB issued FSP FAS 142-3, Determination of the Useful Life of Intangible Assets

(‘‘FSP FAS 142-3’’). FSP FAS 142-3 amends the factors that should be considered in developing renewal

or extension assumptions used to determine the useful life of a recognized intangible asset under

SFAS 142. The intent of FSP FAS 142-3 is to improve the consistency between the useful life of a

recognized intangible asset under SFAS 142 and the period of expected cash flows used to measure the

fair value of the asset under SFAS 141(R) and other applicable accounting literature. U.S. Cellular

adopted FSP FAS 142-3 effective January 1, 2009, and such adoption will have no material impact on its

financial position or results of operations.

In November 2008, the FASB ratified Emerging Issues Task Force (EITF) Issue No. 08-6, Equity Method

Investment Accounting Considerations, EITF Issue No. 08-7, Accounting for Defensive Intangible Assets,

and EITF Issue No. 08-8, Accounting for an Instrument (or an Embedded Feature) with a Settlement

Amount That Is Based on the Stock of an Entity’s Consolidated Subsidiary, to help clarify the application

of SFAS 141(R) and SFAS 160. U.S. Cellular adopted the EITF Issues effective January 1, 2009, and

such adoption will have no material impact to its financial position or results of operations.

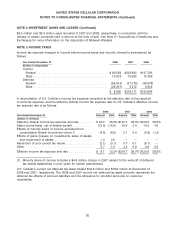

NOTE 2 INVESTMENT GAINS AND LOSSES

Prior to August 7, 2008, U.S. Cellular held 370,882 Common Shares of Rural Cellular Corporation

(‘‘RCC’’). On August 7, 2008, RCC was acquired by Verizon Wireless, with shareholders of RCC receiving

cash of $45 per share in exchange for each RCC share owned. Accordingly, in August 2008, U.S.

Cellular received total cash proceeds of $16.7 million, recognized a pre-tax gain of $16.4 million and

recorded a current tax liability of $5.8 million related to the exchange. The tax liability was substantially

extinguished through 2008 estimated tax payments. As a result of the exchange, U.S. Cellular no longer

had any interest in RCC as of December 31, 2008.

Prior to and during May 2007, U.S. Cellular held Vodafone American Depository Receipts (‘‘ADRs’’) which

were obtained in connection with the sale of non-strategic investments. U.S. Cellular entered into a

number of variable prepaid forward contracts (‘‘forward contracts’’) related to the Vodafone ADRs that it

held. The forward contracts matured in May 2007. U.S. Cellular settled the forward contracts by delivery

of Vodafone ADRs pursuant to the formula in such forward contracts and then disposed of all remaining

Vodafone ADRs. U.S. Cellular recognized a pre-tax gain of $131.7 million at the time of delivery and sale

of the shares in May 2007. As a result, after this settlement in May 2007, U.S. Cellular no longer owned

any Vodafone ADRs and no longer had any liability or other obligations under the related forward

contracts.

In 2006 and 2007, prior to the maturity of the forward contracts related to the Vodafone ADRs in May

2007, U.S. Cellular accounted for embedded collars in the forward contracts as derivative instruments

under the provisions of SFAS 133. Accordingly, changes in the fair value of the embedded collars were

recorded as Fair value adjustment of derivative instruments in the Consolidated Statement of Operations.

Such fair value changes resulted in a loss of $5.4 million and $63.0 million in 2007 and 2006,

respectively. U.S. Cellular estimated the fair value of the embedded collars by application of the Black-

Scholes valuation model.

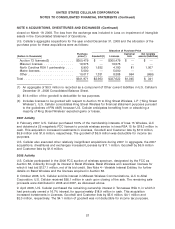

In October of 2006, U.S. Cellular completed the sale of its interest in Midwest Wireless

Communications, LLC (‘‘Midwest Wireless’’) and recorded a gain of $70.4 million. Additional gains of

49