US Cellular 2008 Annual Report Download - page 19

Download and view the complete annual report

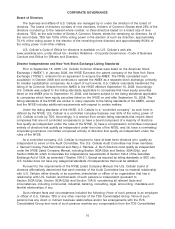

Please find page 19 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Audit Committee is currently composed of three members who qualify as independent under

NYSE listing standards, including Section 10A-3, as discussed above. The current members of the Audit

Committee are J. Samuel Crowley (chairperson), Paul-Henri Denuit and Harry J. Harczak, Jr. The board

of directors has determined that each of the members of the Audit Committee is financially literate and

has ‘‘accounting or related financial management expertise’’ pursuant to listing standards of the NYSE.

In addition, although Mr. Harczak previously was an executive officer of CDW Corporation, which

provides products and services to U.S. Cellular and its affiliates, this interest was not considered to be a

direct or indirect material interest to Mr. Harczak under SEC rules. Nevertheless, U.S. Cellular has elected

to disclose the dollar amount of such products and services in this proxy statement. As set forth above

under ‘‘Election of Directors,’’ U.S. Cellular purchased $276,986 and TDS purchased an additional $4,636

in products and services from CDW in 2007, the last year during which Mr. Harczak served as an

executive officer of CDW.

The board has made a determination that Harry J. Harczak, Jr. is an ‘‘audit committee financial

expert’’ as such term is defined by the SEC.

In accordance with the SEC’s safe harbor rule for ‘‘audit committee financial experts,’’ no member

designated as an audit committee financial expert shall (i) be deemed an ‘‘expert’’ for any other purpose

or (ii) have any duty, obligation or liability that is greater than the duties, obligations and liability imposed

on a member of the board or the audit committee not so designated. Additionally, the designation of a

member or members as an ‘‘audit committee financial expert’’ shall in no way affect the duties,

obligations or liability of any member of the audit committee, or the board, not so designated.

The Audit Committee held ten meetings during 2008.

Pre-Approval Procedures

The Audit Committee adopted a policy, effective May 6, 2003, as amended as of February 17, 2004

and November 1, 2005, pursuant to which all audit and non-audit services provided by U.S. Cellular’s

principal independent registered public accounting firm must be pre-approved by the Audit Committee.

Under no circumstances may U.S. Cellular’s principal independent registered public accounting firm

provide services that are prohibited by the Sarbanes Oxley Act of 2002 or rules issued thereunder.

Non-prohibited audit related services and certain tax and other services may be provided to U.S. Cellular,

subject to such pre-approval process and prohibitions. The Audit Committee has delegated to the

chairperson of the Audit Committee the authority to pre-approve services by the independent registered

public accountants and to report such approvals to the full Audit Committee at each of its regularly

scheduled meetings. The pre-approval policy relates to all services provided by U.S. Cellular’s principal

independent registered public accounting firm and does not include any de minimis exception.

Review, approval or ratification of transactions with related persons

The Audit Committee Charter provides that the Audit Committee shall ‘‘be responsible for the review

and oversight of all related-party transactions, as such term is defined by the rules of the New York Stock

Exchange.’’ Related party transactions are addressed in Sections 307.00 and 314.00 of the NYSE Listed

Company Manual.

Section 314.00 of the NYSE Listed Company Manual states that ‘‘Related party transactions normally

include transactions between officers, directors, and principal shareholders and the company.’’ In

general, ‘‘related party transactions’’ would include transactions required to be disclosed in U.S.

Cellular’s proxy statement pursuant to Item 404 of Regulation S-K of the SEC. Pursuant to Item 404, U.S.

Cellular is required to disclose any transaction, which includes any financial transaction, arrangement, or

relationship (including any indebtedness or guarantee of indebtedness) or a series of transactions, that

has taken place since the beginning of U.S. Cellular’s last fiscal year or any currently proposed

transaction in which: 1. U.S. Cellular was or is to be a participant, 2. the amount involved exceeds

$120,000 and 3. any ‘‘related person’’ had or will have a direct or indirect material interest in the

transaction during any part of the fiscal year. For this purpose, in general, the term ‘‘related person’’

12