US Cellular 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.an officer or other person subject to section 16 of the Exchange Act; or

• decisions concerning the timing, pricing or amount of an award granted to such an employee,

officer or other person.

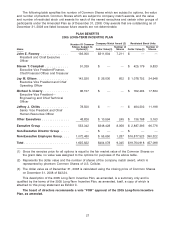

Performance Measures. The Committee may establish performance measures as follows:

• as a condition to the grant or exercisability of all or a portion of an option or SAR;

• as a condition to the grant of restricted stock or RSU awards; or

• during the applicable restriction or performance period as a condition to the award recipient’s

receipt, in the case of restricted stock awards, of the Common Shares subject to such awards, or

in the case of RSU awards or performance awards, of the Common Shares subject to such

awards or the cash amount payable with respect to such awards (or a combination thereof).

To the extent necessary for an award to be ‘‘qualified performance-based compensation’’ within the

meaning of Section 162(m) of the Code, the performance measures shall include one or more of the

following:

• the attainment by a Common Share of a specified fair market value for a specified period of time;

• return to shareholders (including dividends);

• return on assets, equity or capital;

• customer satisfaction or defections;

• gross or net customer additions;

• sales and marketing costs per gross customer addition;

• revenues, earnings or earnings per share;

• average revenue per customer unit;

• market share;

• cash flow; and/or

• cost reduction goals.

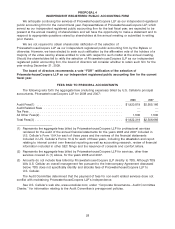

Stock Options. The Amended Plan provides for the grant of ISOs and nonqualified options, and

that the Committee will determine the number of Common Shares subject to an option, the exercise

period of an option, the purchase price per Common Share subject to an option and the other terms of

the option, provided that the purchase price per Common Share is not less than 100% of the fair market

value of such Common Share on the date of grant of the option. The exercise of an option entitles the

optionee to receive whole Common Shares. The aggregate fair market value (determined as of the date

the option is granted) of the Common Shares with respect to which ISOs are exercisable for the first time

by the optionee in any calendar year (under the Amended Plan and any other incentive stock option

plan of U.S. Cellular or any related corporation) may not exceed $100,000. ISOs granted under the

Amended Plan may not be exercised later than ten years from the date of grant. In the case of any

eligible employee who owns or is deemed to own stock possessing more than 10% of the total

combined voting power of all classes of stock of U.S. Cellular or any related corporation, the purchase

price per share of any ISO granted under the Amended Plan may not be less than 110% of the fair

market value of a Common Share on the date of grant, and the exercise period may not exceed five

years from the date of grant.

Upon exercise of a stock option which was awarded prior to March 7, 2006 to an employee who is

an officer, the purchase price may be paid in cash, by delivery of unencumbered whole Common Shares

that have been owned by the option holder for at least six months or purchased by the option holder on

the open market (‘‘mature shares’’), by authorizing U.S. Cellular to withhold whole Common Shares that

otherwise would be delivered, by a combination of cash and delivery of mature shares, or, to the extent

legally permissible, through an arrangement between the option holder and a broker-dealer acceptable

to U.S. Cellular for the payment of the purchase price.

21