Time Magazine 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

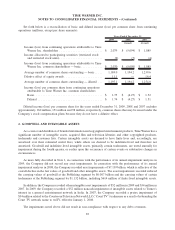

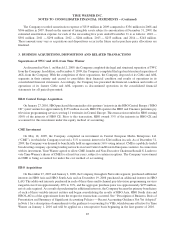

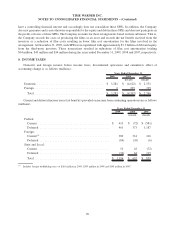

4. INVESTMENTS

The Company’s investments consist of equity-method investments, fair-value and other investments, including

available-for-sale securities, and cost-method investments. Time Warner’s investments, by category, consist of

(millions):

2009 2008

December 31,

(recast)

Equity-method investments ....................................... $ 280 $ 313

Fair-value and other investments, including available-for-sale securities ...... 578 608

Cost-method investments......................................... 323 106

Total ....................................................... $ 1,181 $ 1,027

Equity-Method Investments

At December 31, 2009, investments accounted for using the equity method primarily represented certain

network and filmed entertainment ventures which are generally 20-50% owned. No single investment individually

or in the aggregate is considered significant for the periods presented.

Fair-Value and Other Investments, Including Available-for-Sale Securities

Fair-value and other investments include deferred compensation-related investments, available-for-sale

securities and equity derivative instruments of $544 million, $33 million and $1 million, respectively, as of

December 31, 2009 and $527 million, $80 million and $1 million, respectively, as of December 31, 2008.

Deferred compensation-related investments included $238 million and $230 million at December 31, 2009 and

2008, respectively, which were recorded at fair value, and $306 million and $297 million at December 31, 2009 and

2008, respectively, of Corporate Owned Life Insurance investments, which were recorded at cash surrender value.

The deferred compensation program is an elective unfunded program whereby eligible employees may defer receipt

of a portion of their annual compensation. The amount deferred increases or decreases based on the valuations of the

various hypothetical investment options chosen by the employee. The Company acquires assets in order to

economically hedge the Company’s liability under the deferred compensation program, which varies based on the

performance of the various hypothetical investment options. The corresponding liability for the deferred

compensation program is included within Current or Noncurrent other liabilities as appropriate.

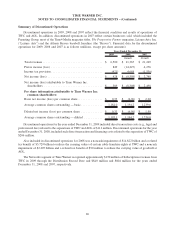

Equity derivatives instruments and available-for-sale securities are recorded at fair value in the consolidated

balance sheet, and the realized gains and losses are included as a component of Other income, net. The cost basis,

unrealized gains, unrealized losses and fair market value of available-for-sale securities are set forth below

(millions):

2009 2008

December 31,

(recast)

Cost basis of available-for-sale securities ............................... $ 21 $ 49

Gross unrealized gain .............................................. 14 31

Gross unrealized loss .............................................. (2) —

Fair value of available-for-sale securities................................ $ 33 $ 80

Deferred tax liability .............................................. $ 5 $ 12

87

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)