Time Magazine 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.standard definition DVDs and the shift to rental services was growing sales of high definition Blu-ray Discs and

increased electronic delivery, which have higher gross margins than standard definition DVDs.

Piracy, including physical piracy as well as illegal online file-sharing, continues to be a significant issue for the

filmed entertainment industry. Due to technological advances, piracy has expanded from music to movies,

television programming and interactive video games. The Company seeks to limit the threat of piracy through

a combination of approaches, including offering legitimate market alternatives, applying technical protection

measures, pursuing legal sanctions for infringement, promoting appropriate legislative initiatives and enhancing

public awareness of the meaning and value of intellectual property. The Company also works with various cross-

industry groups and trade associations, as well as with strategic partners to develop and implement technological

solutions to control digital piracy.

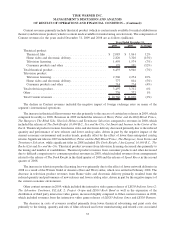

Publishing. Time Warner’s Publishing segment consists principally of magazine publishing and related

websites as well as a number of direct-marketing businesses. In 2009, the Publishing segment generated revenues of

$3.736 billion (14% of the Company’s overall revenues), $419 million in Operating Income before Depreciation

and Amortization and $246 million in Operating Income.

As of December 31, 2009, Time Inc. published 21 magazines in the U.S., including People,Sports Illustrated,

Time,InStyle,Real Simple,Southern Living,Entertainment Weekly and Fortune, and over 90 magazines outside the

U.S., primarily through IPC Media (“IPC”) in the U.K. and Grupo Editorial Expansión (“GEE”) in Mexico. The

Publishing segment generates revenues primarily from advertising (including advertising on digital properties),

magazine subscriptions and newsstand sales. Time Inc. also owns the magazine subscription marketer, Synapse

Group, Inc. (“Synapse”), and the school and youth group fundraising company, QSP, Inc. and its Canadian affiliate,

Quality Service Programs Inc. (collectively, “QSP”). Advertising sales at the Publishing segment, particularly print

advertising sales, were significantly adversely affected by the economic environment during 2009. Online

advertising sales at the Publishing segment have also been adversely affected by the current economic

environment, although, on a percentage basis, to a lesser degree than print advertising sales. Time Inc.

continues to develop digital content, including the relaunch of RealSimple.com and the expansion of

People.com and Time.com, as well as the expansion of digital properties owned by IPC and GEE. For the year

ended December 31, 2009, online Advertising revenues were 12% of Time Inc.’s total Advertising revenues

compared to 10% for the year ended December 31, 2008. On July 16, 2009, Time Inc. completed the sale of its

direct-selling division, Southern Living At Home.

In its ongoing effort to streamline operations and reduce its cost structure, the Publishing segment executed

restructuring initiatives, primarily resulting in headcount reductions, in the fourth quarters of 2009 and 2008. For

the years ended December 31, 2009 and 2008, restructuring costs, primarily consisting of severance costs, were

$99 million and $176 million, respectively.

Recent Developments

Separations of TWC and AOL from Time Warner and Reverse Stock Split of Time Warner Common Stock

On March 12, 2009 (the “Distribution Record Date”), the Company disposed of all of its shares of TWC

common stock and completed the legal and structural separation of TWC from Time Warner (the “TWC

Separation”). In addition, on December 9, 2009, the Company disposed of all of its shares of AOL common

stock and completed the legal and structural separation of AOL from Time Warner (the “AOL Separation”). With

the completion of these separations, the Company disposed of its Cable and AOL segments in their entirety.

Accordingly, the Company has presented the financial condition and results of operations of its former AOL and

Cable segments as discontinued operations in the accompanying consolidated financial statements for all periods

presented. See Notes 1 and 3 to the accompanying consolidated financial statements.

24

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)