Time Magazine 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

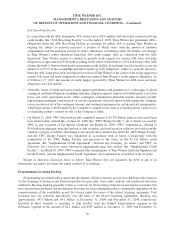

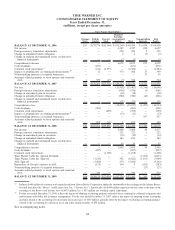

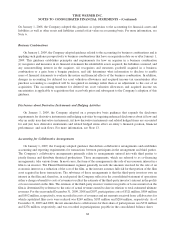

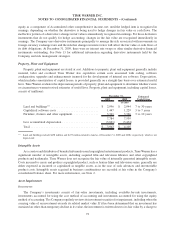

TIME WARNER INC.

CONSOLIDATED STATEMENT OF EQUITY

Years Ended December 31,

(millions, except per share amounts)

Common

Stock

Paid-In

Capital

Treasury

Stock

Retained

Earnings

(Accumulated

Deficit) Total

Noncontrolling

Interests

Total

Equity

Time Warner Shareholders’

BALANCE AT DECEMBER 31, 2006 ............... $15 $170,774 $(19,140) $ (91,260) $ 60,389 $ 4,039 $ 64,428

Net income .................................. — — — 4,387 4,387 240 4,627

Foreign currency translation adjustments ............... — — — 290 290 2 292

Change in unfunded benefit obligation ................ — — — 2 2 (7) (5)

Change in realized and unrealized losses on derivative

financial instruments .......................... — — — (7) (7) — (7)

Comprehensive income .......................... — — — 4,672 4,672 235 4,907

Cash dividends ................................ — (871) — — (871) — (871)

Common stock repurchases

(a)

...................... — (211) (6,373) — (6,584) — (6,584)

Impact of adopting new accounting pronouncements

(b)

..... — 12 — 374 386 13 399

Noncontrolling interests of acquired businesses .......... — — — — — 35 35

Amounts related primarily to stock options and restricted

stock ..................................... 1 559 (13) (3) 544 — 544

BALANCE AT DECEMBER 31, 2007 ............... $16 $170,263 $(25,526) $ (86,217) $ 58,536 $ 4,322 $ 62,858

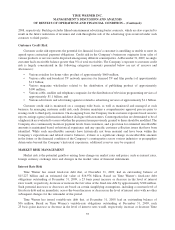

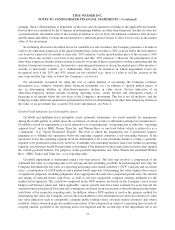

Net loss..................................... — — — (13,402) (13,402) (1,246) (14,648)

Foreign currency translation adjustments ............... — — — (956) (956) (5) (961)

Change in unrealized gain on securities ............... — — — (18) (18) — (18)

Change in unfunded benefit obligation ................ — — — (780) (780) (46) (826)

Change in realized and unrealized losses on derivative

financial instruments .......................... — — — (71) (71) — (71)

Comprehensive loss . . . .......................... — — — (15,227) (15,227) (1,297) (16,524)

Cash dividends ................................ — (901) — — (901) — (901)

Common stock repurchases........................ — — (299) — (299) — (299)

Impact of adopting new accounting pronouncements

(b)

..... — — — (13) (13) — (13)

Noncontrolling interests of acquired businesses .......... — — — — — 357 357

Amounts related primarily to stock options and restricted

stock ..................................... — 202 (11) 1 192 — 192

BALANCE AT DECEMBER 31, 2008 ............... $16 $169,564 $(25,836) $(101,456) $ 42,288 $ 3,382 $ 45,670

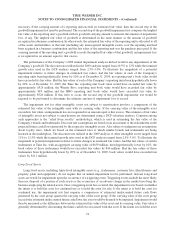

Net income .................................. — — — 2,468 2,468 49 2,517

Foreign currency translation adjustments ............... — — — 221 221 1 222

Change in unrealized gain on securities ............... — — — (12) (12) — (12)

Change in unfunded benefit obligation ................ — — — 183 183 — 183

Change in realized and unrealized losses on derivative

financial instruments .......................... — — — 35 35 — 35

Comprehensive income .......................... — — — 2,895 2,895 50 2,945

Cash dividends ................................ — (897) — — (897) — (897)

Common stock repurchases........................ — — (1,198) — (1,198) — (1,198)

Time Warner Cable Inc. Special Dividend .............. — — — — — (1,603) (1,603)

Time Warner Cable Inc. Spin-off .................... — (7,213) — 391 (6,822) (1,167) (7,989)

AOL Spin-off ................................. — (3,480) — 278 (3,202) — (3,202)

Repurchase of Google’s interest in AOL ............... — (155) — 164 9 (292) (283)

Noncontrolling interests of acquired businesses .......... — — — — — (27) (27)

Amounts related primarily to stock options and restricted

stock ..................................... — 310 — — 310 — 310

BALANCE AT DECEMBER 31, 2009 ............... $16 $158,129 $(27,034) $ (97,728) $ 33,383 $ 343 $ 33,726

(a)

Includes $440 million of common stock repurchased from Liberty Media Corporation, indirectly attributable to the exchange of the Atlanta Braves

baseball franchise (the “Braves”) and Leisure Arts, Inc. (“Leisure Arts”). Specifically, the $440 million represents the fair value at the time of the

exchange of the Braves and Leisure Arts of $473 million, less a $33 million net working capital adjustment.

(b)

For the year ended December 31, 2008, reflects the impact of adopting accounting guidance related to the accounting for collateral assignment and

endorsement split-dollar life insurance arrangements. For the year ended December 31, 2007, reflects the impact of adopting recent accounting

guidance related to the accounting for uncertainty in income taxes of $445 million, partially offset by the impact of adopting accounting guidance

related to the accounting for sabbatical leave and other similar benefits of $59 million.

See accompanying notes.

64