Time Magazine 2009 Annual Report Download - page 69

Download and view the complete annual report

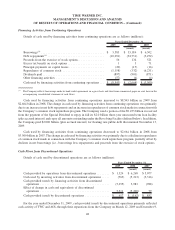

Please find page 69 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2008, respectively. Backlog excludes filmed entertainment advertising barter contracts, which are also expected to

result in the future realization of revenues and cash through the sale of the advertising spots received under such

contracts to third parties.

Customer Credit Risk

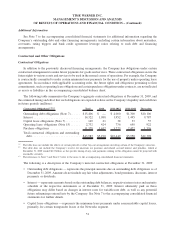

Customer credit risk represents the potential for financial loss if a customer is unwilling or unable to meet its

agreed upon contractual payment obligations. Credit risk in the Company’s businesses originates from sales of

various products or services and is dispersed among many different counterparties. At December 31, 2009, no single

customer had a receivable balance greater than 5% of total receivables. The Company’s exposure to customer credit

risk is largely concentrated in the following categories (amounts presented below are net of reserves and

allowances):

• Various retailers for home video product of approximately $660 million;

• Various cable and broadcast TV network operators for licensed TV and film product of approximately

$1.9 billion;

• Various magazine wholesalers related to the distribution of publishing product of approximately

$100 million;

• Various cable, satellite and telephone companies for the distribution of television programming services of

approximately $1.1 billion; and

• Various advertisers and advertising agencies related to advertising services of approximately $1.1 billion.

Customer credit risk is monitored on a company-wide basis, as well as monitored and managed at each

business. In managing customer credit risk, each division maintains a comprehensive approval process prior to

issuing credit to third-party customers. On an ongoing basis, the Company tracks customer exposure based on news

reports, ratings agency information and direct dialogue with customers. Counterparties that are determined to be of

a higher risk are evaluated to assess whether the payment terms previously granted to them should be modified. The

Company also continuously monitors payment levels from customers, and a provision for estimated uncollectible

amounts is maintained based on historical experience and any specific customer collection issues that have been

identified. While such uncollectible amounts have historically not been material and have been within the

Company’s expectations and related reserve balances, if there is a significant change in uncollectible amounts

in the future or the financial condition of the Company’s counterparties across various industries or geographies

deteriorates beyond the Company’s historical experience, additional reserves may be required.

MARKET RISK MANAGEMENT

Market risk is the potential gain/loss arising from changes in market rates and prices, such as interest rates,

foreign currency exchange rates and changes in the market value of financial instruments.

Interest Rate Risk

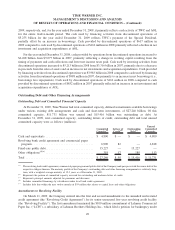

Time Warner has issued fixed-rate debt that, at December 31, 2009, had an outstanding balance of

$15.227 billion and an estimated fair value of $16.976 billion. Based on Time Warner’s fixed-rate debt

obligations outstanding at December 31, 2009, a 25 basis point increase or decrease in the level of interest

rates would, respectively, decrease or increase the fair value of the fixed-rate debt by approximately $308 million.

Such potential increases or decreases are based on certain simplifying assumptions, including a constant level of

fixed-rate debt and an immediate, across-the-board increase or decrease in the level of interest rates with no other

subsequent changes for the remainder of the period.

Time Warner has issued variable-rate debt that, at December 31, 2009, had an outstanding balance of

$36 million. Based on Time Warner’s variable-rate obligations outstanding at December 31, 2009, each

25 basis point increase or decrease in the level of interest rates would, respectively, increase or decrease Time

57

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)