Time Magazine 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.See “Description of Business, Basis of Presentation and Summary of Significant Accounting Policies —

Recent Accounting Guidance Not Yet Adopted” for a description of amendments to the guidance to accounting for

transfers of financial assets, which became effective for Time Warner on January 1, 2010 and will be applied on a

retrospective basis beginning in the first quarter of 2010.

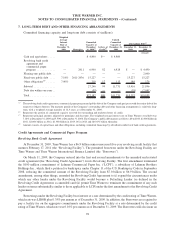

In consideration for the sale of the accounts receivable to the applicable SPE, Time Warner receives cash, which

there is no obligation to repay, and an interest-bearing retained interest, which is included in receivables in the

consolidated balance sheet. Time Warner’s continuing involvement is solely comprised of servicing the Pooled

Receivables on behalf of the applicable SPE. Income received by Time Warner in exchange for this service is equal

to the prevailing market rate for such services, and, accordingly, no servicing asset or liability has been recorded on

the consolidated balance sheet at December 31, 2009. Servicing income has not been material in any period. The

retained interest, which has been adjusted to reflect the portion that is not expected to be collectible, bears an interest

rate that varies with the prevailing market interest rates. The retained interest may become uncollectible to the

extent that the applicable SPE has credit losses and operating expenses. If the financial quality of the receivables

subject to the facilities deteriorate to a certain degree, it is possible that the third-party financial institutions or

commercial paper conduits could cease purchasing new receivables, thus limiting the Company’s access to future

funds under these facilities. Because the sold accounts receivable underlying the retained ownership interest are

generally short-term in nature, the fair value of the retained interest approximated its carrying value at both

December 31, 2009 and December 31, 2008. There were no net proceeds received and repaid under Time Warner’s

accounts receivable securitization program in both 2009 and 2008. For more information refer to Note 17.

Covenants and Rating Triggers

Each of the Company’s Revolving Credit Agreement, public debt indentures and financing arrangements with

SPEs contain customary covenants. A breach of such covenants in the bank credit agreement that continues beyond

any grace period constitutes a default, which can limit the Company’s ability to borrow and can give rise to a right of

the lenders to terminate the Revolving Facility and/or require immediate payment of any outstanding debt. A breach

of such covenants in the public debt indentures beyond any grace period constitutes a default which can require

immediate payment of the outstanding debt. A breach of such covenants in the financing arrangements with SPEs

that continues beyond any grace period can constitute a termination event, which can limit the facility as a future

source of liquidity; however, there would be no claims on the Company for the receivables previously sold to the

SPEs. There are no rating-based defaults or covenants in the Revolving Credit Agreement, public debt indentures or

financing arrangements with SPEs.

Additionally, in the event that the Company’s credit ratings decrease, the cost of maintaining the Revolving

Credit Agreement and Revolving Facility and the cost of borrowing increase and, conversely, if the ratings improve,

such costs decrease. As of December 31, 2009, the Company’s investment grade debt ratings were as follows: Fitch

BBB, Moody’s Baa2, and S&P BBB.

As of December 31, 2009, the Company was in compliance with all covenants in its Revolving Credit

Agreement, public debt indentures and financing arrangements with SPEs. The Company does not anticipate that it

will have any difficulty in the foreseeable future complying with these covenants.

Film Tax-Advantaged Arrangements

The Company’s filmed entertainment business, on occasion, enters into tax-advantaged transactions with

foreign investors that are thought to generate tax benefits for such investors. The Company believes that its tax

profile is not affected by its participation in these arrangements in any jurisdiction. The foreign investors provide

consideration to the Company for entering into these arrangements.

Although these transactions often differ in form, they generally involve circumstances in which the Company

enters into a sale-leaseback arrangement involving its film product with third-party SPEs owned by the foreign

investors. The Company maintains its rights and control over the use of its film product. The Company does not

95

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)