Time Magazine 2009 Annual Report Download - page 97

Download and view the complete annual report

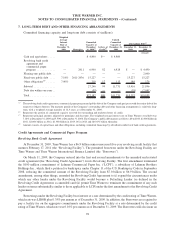

Please find page 97 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company recorded amortization expense of $319 million in 2009 compared to $356 million in 2008 and

$306 million in 2007. Based on the amount of intangible assets subject to amortization at December 31, 2009, the

estimated amortization expense for each of the succeeding five years ended December 31 is as follows: 2010 —

$301 million; 2011 — $298 million; 2012 — $284 million; 2013 — $255 million; and 2014 — $248 million.

These amounts may vary as acquisitions and dispositions occur in the future and as purchase price allocations are

finalized.

3. BUSINESS ACQUISITIONS, DISPOSITIONS AND RELATED TRANSACTIONS

Separations of TWC and AOL from Time Warner

As discussed in Note 1, on March 12, 2009, the Company completed the legal and structural separation of TWC

from the Company. In addition, on December 9, 2009, the Company completed the legal and structural separation of

AOL from the Company. With the completion of these separations, the Company disposed of its Cable and AOL

segments in their entirety and ceased to consolidate their financial condition and results of operations in its

consolidated financial statements. Accordingly, the Company has presented the financial condition and results of

operations of its former Cable and AOL segments as discontinued operations in the consolidated financial

statements for all periods presented.

HBO Central Europe Acquisition

On January 27, 2010, HBO purchased the remainder of its partners’ interests in the HBO Central Europe (“HBO

CE”) joint venture for approximately $155 million in cash. HBO CE operates the HBO and Cinemax premium pay

television programming services serving 11 territories in Central Europe. This transaction resulted in HBO owning

100% of the interests of HBO CE. Prior to this transaction, HBO owned 33% of the interests in HBO CE and

accounted for this investment under the equity method of accounting.

CME Investment

On May 18, 2009, the Company completed an investment in Central European Media Enterprises Ltd.

(“CME”), in which the Company received a 31% economic interest for $246 million in cash. As of December 31,

2009, the Company was deemed to beneficially hold an approximate 36% voting interest. CME is a publicly-traded

broadcasting company operating leading networks in seven Central and Eastern European countries. In connection

with its investment, Time Warner agreed to allow CME founder and Non-Executive Chairman Ronald S. Lauder to

vote Time Warner’s shares of CME for at least four years, subject to certain exceptions. The Company’s investment

in CME is being accounted for under the cost method of accounting.

HBO Acquisitions

On December 27, 2007 and January 2, 2008, the Company, through its Networks segment, purchased additional

interests in HBO Asia and HBO South Asia and on December 19, 2008 purchased an additional interest in HBO

LAG. The additional interests purchased in each of these three multi-channel pay-television programming services

ranged in size from approximately 20% to 30%, and the aggregate purchase price was approximately $275 million,

net of cash acquired. As a result of purchasing the additional interests, the Company became the primary beneficiary

of each of these variable interest entities and began consolidating the results of HBO Asia, HBO South Asia and

HBO LAG as of the approximate dates the respective transactions occurred. See “Description of Business, Basis of

Presentation and Summary of Significant Accounting Policies — Recent Accounting Guidance Not Yet Adopted”

in Note 1 for a description of amendments to the guidance to accounting for VIEs, which became effective for Time

Warner on January 1, 2010 and will be applied on a retrospective basis beginning in the first quarter of 2010.

85

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)