Time Magazine 2009 Annual Report Download - page 113

Download and view the complete annual report

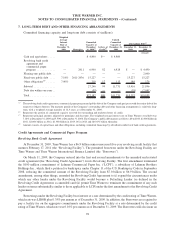

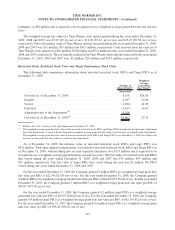

Please find page 113 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.condition is reflected in the grant date fair value of the award, which is estimated using a Monte Carlo analysis to

estimate the total return ranking of Time Warner among the S&P 500 Index companies over the performance period.

In the case of PSUs granted in 2009, the performance condition is assumed to have been met. As a result,

compensation expense is recognized on these awards provided that the requisite service is rendered (regardless of

the actual TSR ranking achieved). Based on market data as of December 31, 2009, the PSUs granted in 2009 and

2008 are tracking at a level that, if maintained, would result in the award of 137% and 121%, respectively, of target

PSUs granted. For PSUs granted in 2007, the actual performance level achieved by the Company over the

performance period, which ended on December 31, 2009, was 69%. Participants who are terminated by the

Company other than for cause or who terminate their own employment for good reason or due to retirement or

disability are generally entitled to a pro rata portion of the PSUs that would otherwise vest at the end of the

performance period.

Holders of PSUs granted prior to 2010 do not receive payments or accruals of dividends or dividend equivalents

for regular quarterly cash dividends paid by the Company while the PSU is outstanding. Holders of PSUs granted

beginning in 2010 will be entitled to receive dividend equivalents based on the regular quarterly cash dividends

declared and paid by the Company during the period that the PSUs are outstanding. The dividend equivalent

payment will be made in cash following the vesting of the PSUs (generally following the end of the respective

performance period) and will be based on the number of shares paid out.

Upon the (i) exercise of a stock option award, (ii) the vesting of a RSU, (iii) the vesting of a PSU or (iv) the grant

of restricted stock, shares of Time Warner common stock may be issued either from authorized but unissued shares

or from treasury stock.

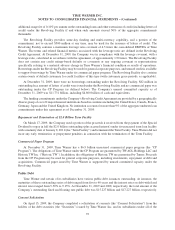

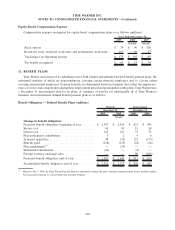

In connection with the AOL Separation and the TWC Separation (collectively, the “Separations”), and as

provided for in the Company’s equity plans, the number of stock options, RSUs and target PSUs outstanding at each

of the Distribution Date and Distribution Record Date, respectively, and the exercise prices of such stock options

were adjusted to maintain the fair value of those awards (collectively, the “Adjustments”). The Adjustments were

determined by comparing the fair value of such awards immediately prior to each of the Separations (“pre-

Separation”) to the fair value of such awards immediately after each of the Separations. In performing these

analyses, the only assumptions that changed were related to the Time Warner stock price and the stock option’s

exercise price. Accordingly, each equity award outstanding as of the Distribution Date relating to the AOL

Separation was increased by multiplying the size of such award by 1.07, while the per share exercise price of each

stock option was decreased by dividing by 1.07. Each equity award outstanding as of the Distribution Record Date

relating to the TWC Separation was increased by multiplying the size of such award by 1.35, while the per share

exercise price of each stock option was decreased by dividing by 1.35. The Adjustments resulted in an aggregate

increase of approximately 65 million equity awards (comprised of 60 million stock options and 5 million RSUs and

Target PSUs) and are included in the line item “Adjustment due to the Separations” in the tables that follow. The

modifications to the outstanding equity awards were made pursuant to existing antidilution provisions in the

Company’s equity plans and did not result in any additional compensation expense.

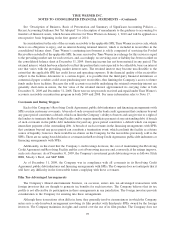

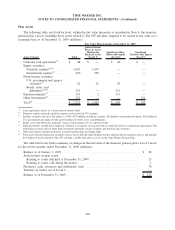

Under the terms of Time Warner’s equity plans and related award agreements, and as a result of the Separations,

AOL and TWC employees who held Time Warner equity awards were treated as if their employment with Time

Warner was terminated without cause at the time of each of the Separations. This treatment resulted in the forfeiture

of unvested stock options, shortened exercise periods for vested stock options and pro rata vesting of the next

installment of (and forfeiture of the remainder of) the RSU awards for those AOL and TWC employees who did not

satisfy retirement-treatment eligibility provisions in the Time Warner equity plans and related award agreements.

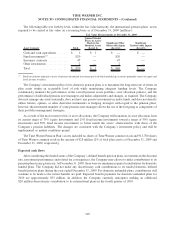

Upon the exercise of Time Warner stock options and the vesting of Time Warner RSUs held by TWC

employees, TWC is obligated to reimburse Time Warner for the intrinsic value of the applicable award. As a result

of the TWC Separation, TWC is no longer considered a related party. Accordingly, on the Distribution Record Date,

the Company established an asset of $16 million for the estimated fair value (determined using the Black-Scholes

option pricing model) of outstanding equity awards held by TWC employees, with an offsetting adjustment to Time

101

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)