Time Magazine 2009 Annual Report Download - page 110

Download and view the complete annual report

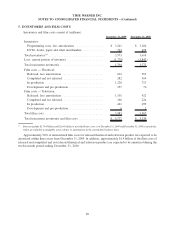

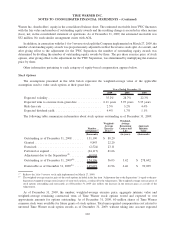

Please find page 110 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.carryforwards consist primarily of approximately $163 million tax benefit attributable to tax losses and $75 million

of business credits. In addition, the Company has approximately $139 million of tax benefit attributable to tax losses

in various foreign jurisdictions that are primarily from countries with unlimited carryforward periods. However,

many of these foreign losses are attributable to specific operations that may not be utilized against income from

other operations of the Company. The utilization of the U.S. federal carryforwards to offset future taxable income is

subject to limitations under U.S. federal income tax laws. Capital losses expire beginning in 2013 and can only be

utilized against capital gains. Foreign tax credits expire in 2013. The state and local tax loss carryforwards and

credits expire in varying amounts from 2010 through 2029.

For accounting purposes, the Company records equity-based compensation expense and a related deferred tax

asset for the future tax deductions it may receive. For income tax purposes, the Company receives a tax deduction

equal to the stock price on the date that a restricted stock unit (or performance share unit) vests or the excess of the

stock price over the exercise price of an option upon exercise. As of December 31, 2009, the deferred tax asset

recognized for equity-based compensation awards is substantially greater than the tax benefit the Company may

ultimately receive (assuming no increase in the Company’s stock price). The applicable accounting rules require

that the deferred tax asset related to an equity-based compensation award be reduced only at the time the award

vests (for a restricted stock unit or performance share unit), is exercised (for a stock option) or otherwise expires or

is cancelled. This reduction is recorded as an adjustment to additional paid-in capital (“APIC”), to the extent that the

realization of excess tax deductions on prior equity-based compensation awards were recorded directly to APIC.

The cumulative amount of such excess tax deductions is referred to as the Company’s “APIC Pool” and was

approximately $1.0 billion at December 31, 2009. Any shortfall balance recognized in excess of the Company’s

APIC Pool is charged to income tax expense in the consolidated statement of operations.

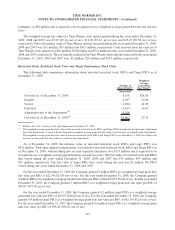

Accounting for Uncertainty in Income Taxes

On January 1, 2007, the Company adopted guidance relating to the recognition of income tax benefits for those

tax positions determined more likely than not to be sustained upon examination, based on the technical merits of the

positions. Upon adoption of the guidance on January 1, 2007, the Company recognized $445 million of tax benefits

for positions that were previously unrecognized, of which $433 million was accounted for as a reduction to the

accumulated deficit balance and $12 million was accounted for as an increase to the paid-in-capital balance as of

January 1, 2007. Additionally, the adoption of accounting guidance related to income tax uncertainties resulted in

the recognition of additional tax reserves for positions where there was uncertainty about the timing or character of

such deductibility. These additional reserves were largely offset by increased deferred tax assets. The reserve for

uncertain income tax positions is included in other liabilities in the consolidated balance sheet.

The Company does not currently anticipate that its existing reserves related to uncertain tax positions as of

December 31, 2009 will significantly increase or decrease during the twelve-month period ending December 31,

2010; however, various events could cause the Company’s current expectations to change in the future. Should the

Company’s position with respect to the majority of these uncertain tax positions be upheld, the effect would be

recorded in the statement of operations as part of the income tax provision.

The impact of temporary differences and tax attributes are considered when calculating interest and penalty

accruals associated with the tax reserve. The amount accrued for interest and penalties as of December 31, 2009 and

December 31, 2008 was $273 million and $196 million, respectively. The Company’s policy is to recognize interest

and penalties accrued on uncertain tax positions as part of income tax expense.

98

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)