Time Magazine 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

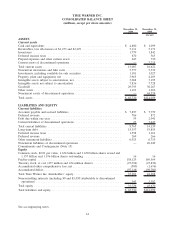

Most of the Company’s other long-term liabilities reflected in the consolidated balance sheet have been

incorporated in the estimated timing of cash payments provided in the summary of contractual obligations, the most

significant of which is an approximate $1.242 billion liability for film licensing obligations. However, certain long-

term liabilities and deferred credits have been excluded from the summary because there are no cash outflows

associated with them (e.g., deferred revenue) or because the cash outflows associated with them are uncertain or do

not represent a purchase obligation as it is used herein (e.g., deferred taxes, participations and royalties, deferred

compensation and other miscellaneous items). Contractual capital commitments are also included in the preceding

table; however, these commitments represent only a small part of the Company’s expected capital spending in 2010

and beyond. Additionally, minimum pension funding requirements have not been presented, as such amounts have

not been determined beyond 2009. The Company did not have a required minimum pension contribution obligation

for its funded defined benefit pension plans in 2009.

Future Film Licensing Obligations

In addition to the purchase obligations previously discussed, the Company has certain future film licensing

obligations, which represent studio movie deal commitments to acquire the right to air movies that will be released

in the future (i.e., after December 31, 2009). These arrangements do not meet the definition of a purchase obligation

since there are neither fixed nor minimum quantities under the arrangements. As future film licensing obligations

are significant to its business, the Company has summarized these arrangements below. Given the variability in the

terms of these arrangements, significant estimates were involved in the determination of these obligations,

including giving consideration to historical box office performance and studio release trends. Actual amounts,

once known, could differ significantly from these estimates (millions).

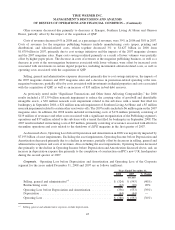

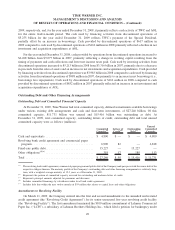

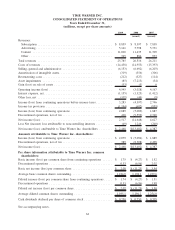

Total 2010 2011-2012 2013-2014 Thereafter

Future Film Licensing Obligations .......... $5,211 $480 $1,525 $1,484 $1,722

Contingent Commitments

The Company also has certain contractual arrangements that would require it to make payments or provide

funding if certain circumstances occur (“contingent commitments”). Contingent commitments include contingent

consideration to be paid in connection with acquisitions and put/call arrangements on certain investment

transactions, which could require the Company to make payments to acquire certain assets or ownership interests.

The following table summarizes separately the Company’s contingent commitments at December 31, 2009. For

put/call options where payment obligations are outside the control of the Company, the timing of amounts presented

in the table represents the earliest period in which payment could be made. For other contingent commitments, the

timing of amounts presented in the table represents when the maximum contingent commitment will expire, but

does not mean that the Company expects to incur an obligation to make any payments within that time period. In

addition, amounts presented do not reflect the effects of any indemnification rights the Company might possess

(millions).

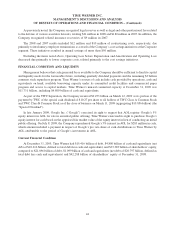

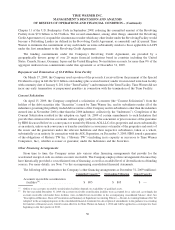

Nature of Contingent Commitments

Total

Commitments 2010 2011-2012 2013-2014 Thereafter

Guarantees

(a)

.................. $ 1,589 $ 322 $ 81 $ 172 $ 1,014

Letters of credit and other contingent

commitments ................ 1,292 152 418 328 394

Total contingent commitments ..... $ 2,881 $ 474 $ 499 $ 500 $ 1,408

(a)

Amounts primarily reflect the Six Flags Guarantee and the guarantee of the AOL Revolving Facility discussed below.

53

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)