Time Magazine 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

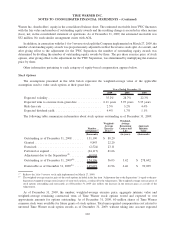

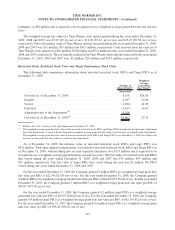

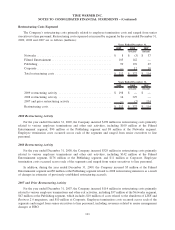

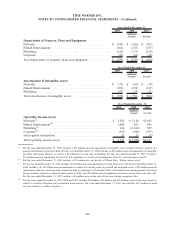

Weighted-average assumptions used to determine net periodic benefit cost for the years ended December 31:

2009 2008 2007 2009 2008 2007

Domestic International

(recast) (recast)

Discount rate ............................ 6.09%

(a)

6.01% 6.00% 6.45% 5.92% 5.15%

Expected long-term return on plan assets ........ 8.00% 8.00% 8.00% 7.13% 7.34% 6.85%

Rate of compensation increase ............... 4.49% 4.49% 4.49% 4.87% 4.88% 4.70%

(a)

One of the domestic unfunded plans was remeasured on September 30, 2009 and December 31, 2009 using a discount rate of 5.52% and

5.43%, respectively. The remeasurements were performed in connection with plan settlements that occurred during the year.

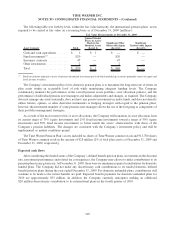

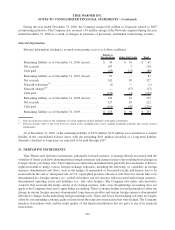

For domestic plans, the discount rate for the plan year ended December 31, 2007 was determined by

comparison against the Moody’s Aa Corporate Index rate, adjusted for coupon frequency and duration of the

obligation, consistent with prior periods. The resulting discount rate was supported by periodic matching of plan

liability cash flows to a pension yield curve constructed of a large population of high-quality corporate bonds.

Effective with the plan year ended December 31, 2008, the Company refined the discount rate determination

process it uses to rely on the matching of plan liability cash flows to a pension yield curve constructed of a large

population of high-quality corporate bonds, without comparison against the Moody’s Aa Corporate Index rate. A

decrease in the discount rate of 25 basis points, from 6.09% to 5.84%, while holding all other assumptions constant,

would have resulted in an increase in the Company’s domestic pension expense of approximately $10 million in

2009. For international plans, the discount rate for plan years ended December 31, 2008 and 2007 was determined

by comparison against country-specific Aa Corporate Indices, adjusted for the duration of the obligation. Effective

for the plan year ending on December 31, 2009, the Company refined the discount rate determination process for

international plans to rely on the matching of plan liability cash flows to pension yield curves constructed of a large

population of high-quality corporate bonds.

In developing the expected long-term rate of return on plan assets, the Company considered long term historical

rates of return as well as the opinions and outlooks of portfolio managers. The Company also considered the

findings of various investment consulting firms over a range of asset allocations. The expected long-term rate of

return for domestic plans is consistent with the Company’s asset allocation policy which is further discussed below.

A decrease in the expected long-term rate of return of 25 basis points, from 8.00% to 7.75%, while holding all other

assumptions constant, would have resulted in an increase in the Company’s domestic pension expense of

approximately $4 million in 2009. A similar approach has been utilized in selecting the expected long-term

rates of return for plans covering international employees.

107

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)