Time Magazine 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Warner’s annual interest expense and related cash payments by an insignificant amount. Such potential increases or

decreases are based on certain simplifying assumptions, including a constant level of variable-rate debt for all

maturities and an immediate, across-the-board increase or decrease in the level of interest rates with no other

subsequent changes for the remainder of the period. Similarly, since almost all of the Company’s cash balance of

$4.800 billion is invested in variable-rate interest-earning assets, the Company would also earn more (less) interest

income due to such an increase (decrease) in interest rates.

From time to time, the Company may use interest rate swaps or other similar derivative financial instruments to

hedge the fair value of its fixed-rate obligations or the future cash flows of its variable-rate obligations. At

December 31, 2009, there were no interest rate swaps or other similar derivative financial instruments outstanding.

Foreign Currency Risk

Time Warner uses foreign exchange contracts primarily to hedge the risk that unremitted or future royalties and

license fees owed to Time Warner domestic companies for the sale or anticipated sale of U.S. copyrighted products

abroad may be adversely affected by changes in foreign currency exchange rates. Similarly, the Company enters

into foreign exchange contracts to hedge certain film production costs abroad as well as other transactions, assets

and liabilities denominated in a foreign currency. As part of its overall strategy to manage the level of exposure to

the risk of foreign currency exchange rate fluctuations, Time Warner hedges a portion of its foreign currency

exposures anticipated over the calendar year. The hedging period for royalties and license fees covers revenues

expected to be recognized during the calendar year; however, there is often a lag between the time that revenue is

recognized and the transfer of foreign-denominated cash back into U.S. dollars. To hedge this exposure, Time

Warner uses foreign exchange contracts that generally have maturities of three months to eighteen months and

provide continuing coverage throughout the hedging period. At December 31, 2009 and 2008, Time Warner had

contracts for the sale of $2.320 billion and $1.840 billion, respectively, and the purchase of $1.762 billion and

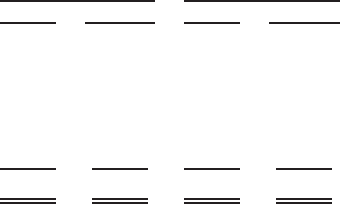

$2.234 billion, respectively, of foreign currencies at fixed rates. The following provides a summary of foreign

currency contracts by currency (millions):

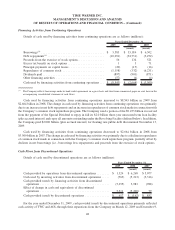

Sales Purchases Sales Purchases

December 31, 2009 December 31, 2008

(recast) (recast)

British pound .................................. $ 684 $ 519 $ 682 $1,027

Euro......................................... 482 243 402 332

Canadian dollar ................................ 484 338 311 265

Australian dollar ................................ 331 419 199 315

Other ........................................ 339 243 246 295

Total ........................................ $2,320 $1,762 $1,840 $2,234

Based on the foreign exchange contracts outstanding at December 31, 2009, a 10% devaluation of the

U.S. dollar as compared to the level of foreign exchange rates for currencies under contract at December 31, 2009

would result in approximately $56 million of net unrealized losses. Conversely, a 10% appreciation of the

U.S. dollar would result in approximately $56 million of net unrealized gains. For a hedge of forecasted royalty or

license fees denominated in a foreign currency, consistent with the nature of the economic hedge provided by such

foreign exchange contracts, such unrealized gains or losses largely would be offset by corresponding decreases or

increases, respectively, in the dollar value of future foreign currency royalty and license fee payments that would be

received in cash within the hedging period from the sale of U.S. copyrighted products abroad. See Note 13 to the

accompanying consolidated financial statements for additional discussion.

Equity Risk

The Company is exposed to market risk as it relates to changes in the market value of its investments. The

Company invests in equity instruments of public and private companies for operational and strategic business

58

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)