Time Magazine 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

indentures governing the publicly traded debt securities of the Company and its subsidiaries other than the indenture

entered into in November 2006 (other than the 2006 Indenture, collectively, the “Indentures”). Completion of the

Consent Solicitation resulted in the adoption on April 16, 2009 of certain amendments to each Indenture that

provide that certain restrictive covenants will not apply (subject to the concurrent or prior issuance of the guarantee

by HBO discussed below) to a conveyance or transfer by Historic AOL LLC of its properties and assets substantially

as an entirety, unless such conveyance or transfer constitutes a conveyance or transfer of the properties and assets of

the issuer and the guarantors under the relevant Indenture and their respective subsidiaries, taken as a whole,

substantially as an entirety. In connection with the AOL Separation, on December 3, 2009, HBO issued a guarantee

of the obligations of Historic TW (including in its capacity as successor to Time Warner Companies, Inc.), whether

as issuer or guarantor, under the Indentures and the Securities.

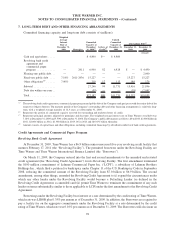

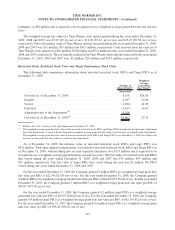

Capital Leases

The Company has entered into various leases primarily related to network equipment that qualify as capital

lease obligations. As a result, the present value of the remaining future minimum lease payments is recorded as a

capitalized lease asset and related capital lease obligation in the consolidated balance sheet. Assets recorded under

capital lease obligations totaled $183 million and $165 million as of December 31, 2009 and 2008, respectively.

Related accumulated amortization totaled $75 million and $52 million as of December 31, 2009 and 2008,

respectively.

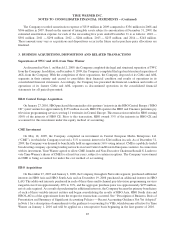

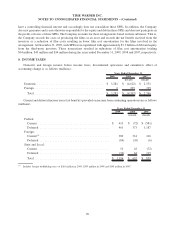

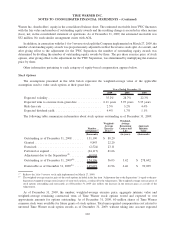

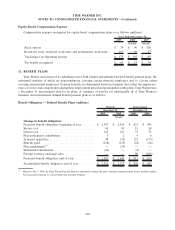

Future minimum capital lease payments at December 31, 2009 are as follows (millions):

2010 ................................................................. $ 21

2011 ................................................................. 20

2012 ................................................................. 18

2013 ................................................................. 18

2014 ................................................................. 15

Thereafter ............................................................. 57

Total ................................................................. 149

Amount representing interest ............................................... (35)

Present value of minimum lease payments ..................................... 114

Current portion ......................................................... (16)

Total long-term portion . . . ................................................ $ 98

Accounts Receivable Securitization Facilities

Time Warner has two accounts receivable securitization facilities that provide for the accelerated receipt of up

to an aggregate of $805 million of cash on certain available short-term home video and network programming

distribution trade accounts receivable. At December 31, 2009, these facilities were fully utilized. In connection with

each of these securitization facilities, subsidiaries of the Company (each a “transferor”) sell, on a revolving and

nonrecourse basis, their accounts receivable meeting specific criteria (“Pooled Receivables”) to a wholly owned

special purpose entity (“SPE”). This sale is designed such that the possibility that the transferor or its creditors could

reclaim the assets is remote, even in bankruptcy. The SPE then transfers a percentage interest in these receivables to

third-party financial institutions or commercial paper conduits sponsored by financial institutions. These

securitization transactions are accounted for as sales because the Company has relinquished control of the

securitized receivables. Accordingly, accounts receivable sold to the SPEs under these facilities are excluded

from receivables in the consolidated balance sheet. The Company is not the primary beneficiary with regard to these

financial institutions or commercial paper conduits and, accordingly, does not consolidate their operations.

94

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)