Time Magazine 2009 Annual Report Download - page 66

Download and view the complete annual report

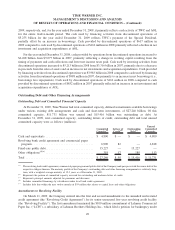

Please find page 66 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The following is a description of the Company’s contingent commitments at December 31, 2009:

• Guarantees include guarantees the Company has provided on certain lease and operating commitments

entered into by (a) entities formerly owned by the Company including the arrangements described below

and (b) ventures in which the Company is or was a venture partner.

Six Flags

In connection with the Company’s former investment in the Six Flags theme parks located in Georgia and

Texas (“Six Flags Georgia” and “Six Flags Texas,” respectively, and, collectively, the “Parks”), in 1997,

certain subsidiaries of the Company (including Historic TW) agreed to guarantee (the “Six Flags

Guarantee”) certain obligations of the partnerships that hold the Parks (the “Partnerships”) for the

benefit of the limited partners in such Partnerships, including the following (the “Guaranteed

Obligations”): (a) making a minimum annual distribution to the limited partners of the Partnerships

(the minimum was approximately $60.7 million in 2009 and is subject to annual cost of living adjustments);

(b) making a minimum amount of capital expenditures each year (an amount approximating 6% of the

Parks’ annual revenues); (c) offering each year to purchase 5% of the limited partnership units of the

Partnerships (plus any such units not purchased pursuant to such offer in any prior year) based on an

aggregate price for all limited partnership units at the higher of (i) $250 million in the case of Six Flags

Georgia and $374.8 million in the case of Six Flags Texas (the “Base Valuations”) and (ii) a weighted

average multiple of EBITDA for the respective Park over the previous four-year period (the “Cumulative LP

Unit Purchase Obligation”); (d) making annual ground lease payments; and (e) either (i) purchasing all of

the outstanding limited partnership units through the exercise of a call option upon the earlier of the

occurrence of certain specified events and the end of the term of each of the Partnerships in 2027 (Six Flags

Georgia) and 2028 (Six Flags Texas) (the “End of Term Purchase”) or (ii) causing each of the Partnerships to

have no indebtedness and to meet certain other financial tests as of the end of the term of the Partnership.

The aggregate amount payable in connection with an End of Term Purchase option on either Park will be the

Base Valuation applicable to such Park, adjusted for changes in the consumer price index from December

1996, in the case of Six Flags Georgia, and December 1997, in the case of Six Flags Texas, through

December of the year immediately preceding the year in which the End of Term Purchase occurs, in each

case, reduced ratably to reflect limited partnership units previously purchased.

In connection with the Company’s 1998 sale of Six Flags Entertainment Corporation (which held the

controlling interests in the Parks) to Six Flags, Inc. (formerly Premier Parks Inc.) (“Six Flags”), Six Flags

and Historic TW entered into a Subordinated Indemnity Agreement pursuant to which Six Flags agreed to

guarantee the performance of the Guaranteed Obligations when due and to indemnify Historic TW, among

others, in the event that the Guaranteed Obligations are not performed and the Six Flags Guarantee is called

upon. In the event of a default of Six Flags’ obligations under the Subordinated Indemnity Agreement, the

Subordinated Indemnity Agreement and related agreements provide, among other things, that Historic TW

has the right to acquire control of the managing partner of the Parks. Six Flags’ obligations to Historic TW

are further secured by its interest in all limited partnership units that are held by Six Flags. To date, no

payments have been made by the Company pursuant to the Six Flags Guarantee.

In connection with the TWC Separation, guarantees previously made by Time Warner Entertainment

Company, L.P. (“TWE”), a subsidiary of TWC, were terminated and, pursuant to and as required under the

original terms of the Six Flags Guarantee, Warner Bros. Entertainment Inc. (“WBEI”) became a guarantor.

In addition, TWE’s rights and obligations under the Subordinated Indemnity Agreement have been assigned

to WBEI. The Company continues to indemnify TWE in connection with any residual exposure of TWE

under the Guaranteed Obligations.

54

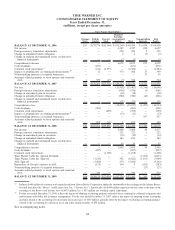

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)