Time Magazine 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the year ended December 31, 2008, the Company incurred $1 million at Corporate related to 2007

restructuring initiatives. The Company also reversed a $3 million charge at the Networks segment during the year

ended December 31, 2008 as a result of changes in estimates of previously established restructuring accruals.

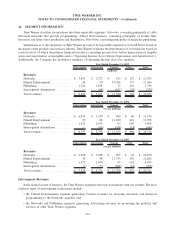

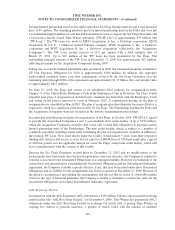

Selected Information

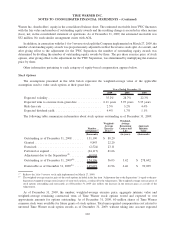

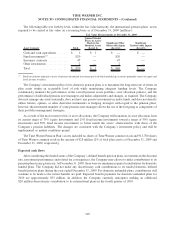

Selected information relating to accrued restructuring costs is as follows (millions):

Employee

Terminations Other Exit Costs Total

Remaining liability as of December 31, 2006 (recast) ..... $ 45 $ 16 $ 61

Net accruals ................................... 107 7 114

Cash paid ..................................... (65) (23) (88)

Remaining liability as of December 31, 2007 (recast) ..... 87 — 87

Net accruals ................................... 242 85 327

Noncash reductions

(a)

............................ (1) — (1)

Noncash charges

(b)

.............................. — (17) (17)

Cash paid ..................................... (134) (5) (139)

Remaining liability as of December 31, 2008 (recast) ..... 194 63 257

Net accruals ................................... 127 85 212

Cash paid ..................................... (166) (50) (216)

Remaining liability as of December 31, 2009 ........... $ 155 $ 98 $ 253

(a)

Noncash reductions relate to the settlement of certain employee-related liabilities with equity instruments.

(b)

Noncash charges relate to the write down of certain assets, including fixed assets, prepaid marketing materials and certain contract

terminations.

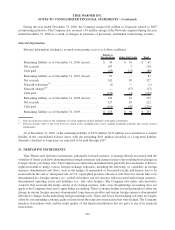

As of December 31, 2009, of the remaining liability of $253 million, $152 million was classified as a current

liability in the consolidated balance sheet, with the remaining $101 million classified as a long-term liability.

Amounts classified as long-term are expected to be paid through 2017.

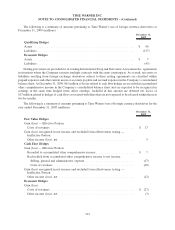

13. DERIVATIVE INSTRUMENTS

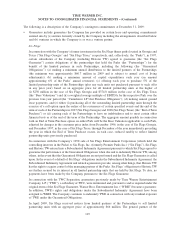

Time Warner uses derivative instruments, principally forward contracts, to manage the risk associated with the

volatility of future cash flows denominated in foreign currencies and changes in fair value resulting from changes in

foreign currency exchange rates. The Company uses derivative instruments that generally have maturities of three to

eighteen months to hedge various foreign exchange exposures, including the following: (i) variability in foreign

currency-denominated cash flows, such as the hedges of unremitted or forecasted royalty and license fees to be

received from the sale or anticipated sale of U.S. copyrighted products abroad or cash flows for certain film costs

denominated in a foreign currency (i.e., cash flow hedges) and (ii) currency risk associated with foreign currency-

denominated operating assets and liabilities (i.e., fair value hedges). The Company also enters into derivative

contracts that economically hedge certain of its foreign currency risks, even though hedge accounting does not

apply or the Company elects not to apply hedge accounting. These economic hedges are used primarily to offset the

change in certain foreign currency-denominated, long-term receivables and certain foreign currency-denominated

debt due to changes in the underlying foreign exchange rates. Gains and losses from hedging activities are largely

offset by corresponding economic gains or losses from the respective transactions that were hedged. The Company

monitors its positions with, and the credit quality of, the financial institutions that are party to any of its financial

transactions.

112

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)