Time Magazine 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

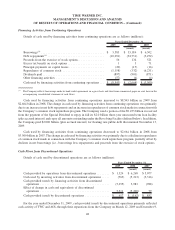

2009, respectively, and, for the year ended December 31, 2008, it primarily reflects cash activity of TWC and AOL

for the entire twelve-month period. The cash used by financing activities from discontinued operations of

$5.255 billion for the year ended December 31, 2009 reflects TWC’s payment of the Special Dividend,

partially offset by an increase in borrowings. Cash provided by discontinued operations of $617 million in

2009 compared to cash used by discontinued operations of $162 million in 2008 primarily reflected a decline in net

investment and acquisition expenditures at AOL.

For the year ended December 31, 2008, cash provided by operations from discontinued operations increased to

$6.268 billion from $5.077 billion in 2007, primarily reflecting a change in working capital resulting from the

timing of payments and cash collections and lower net income taxes paid. Cash used by investing activities from

discontinued operations increased to $5.213 billion in 2008 from $3.316 billion in 2007, primarily due to a decrease

in proceeds from the sales of assets and an increase in net investments and acquisition expenditures. Cash provided

by financing activities from discontinued operations was $3.983 billion in 2008 compared to cash used by financing

activities from discontinued operations of $988 million in 2007, due primarily to an increase in net borrowings (i.e.,

borrowings less repayments). Cash used by discontinued operations of $162 million in 2008 compared to cash

provided by discontinued operations of $852 million in 2007 primarily reflected an increase in net investment and

acquisition expenditures at AOL.

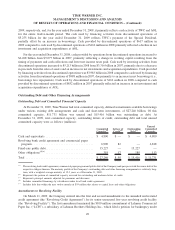

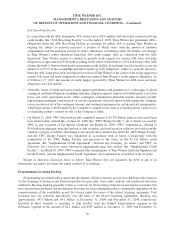

Outstanding Debt and Other Financing Arrangements

Outstanding Debt and Committed Financial Capacity

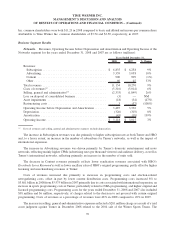

At December 31, 2009, Time Warner had total committed capacity, defined as maximum available borrowings

under various existing debt arrangements and cash and short-term investments, of $27.246 billion. Of this

committed capacity, $11.731 billion was unused and $15.416 billion was outstanding as debt. At

December 31, 2009, total committed capacity, outstanding letters of credit, outstanding debt and total unused

committed capacity were as follows (millions):

Committed

Capacity

(a)

Letters of

Credit

(b)

Outstanding

Debt

(c)

Unused

Committed

Capacity

Cash and equivalents ............................. $ 4,800 $ — $ — $ 4,800

Revolving bank credit agreement and commercial paper

program ..................................... 6,900 82 — 6,818

Fixed-rate public debt............................. 15,227 — 15,227 —

Other obligations

(d)(e)

............................. 319 17 189 113

Total ......................................... $ 27,246 $ 99 $ 15,416 $ 11,731

(a)

The revolving bank credit agreement, commercial paper program and public debt of the Company rank pari passu with the senior debt of the

respective obligors thereon. The maturity profile of the Company’s outstanding debt and other financing arrangements is relatively long-

term, with a weighted average maturity of 12.3 years as of December 31, 2009.

(b)

Represents the portion of committed capacity reserved for outstanding and undrawn letters of credit.

(c)

Represents principal amounts adjusted for premiums and discounts.

(d)

Includes committed financings by subsidiaries under local bank credit agreements.

(e)

Includes debt due within the next twelve months of $59 million that relates to capital lease and other obligations.

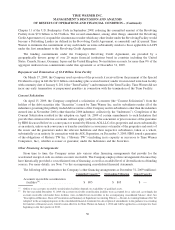

Amendments to Revolving Facility

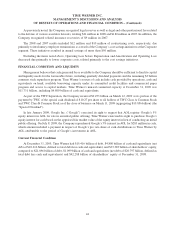

On March 11, 2009, the Company entered into the first and second amendments to the amended and restated

credit agreement (the “Revolving Credit Agreement”) for its senior unsecured five-year revolving credit facility

(the “Revolving Facility”). The first amendment terminated the $100 million commitment of Lehman Commercial

Paper Inc. (“LCPI”), a subsidiary of Lehman Brothers Holdings Inc., which filed a petition for bankruptcy under

49

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)