Time Magazine 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chapter 11 of the U.S. Bankruptcy Code in September 2008, reducing the committed amount of the Revolving

Facility from $7.0 billion to $6.9 billion. The second amendment, among other things, amended the Revolving

Credit Agreement to (i) expand the circumstances under which any other lender under the Revolving Facility would

become a Defaulting Lender (as defined in the Revolving Credit Agreement, as amended) and (ii) permit Time

Warner to terminate the commitment of any such lender on terms substantially similar to those applicable to LCPI

under the first amendment to the Revolving Credit Agreement.

The funding commitments under the Company’s Revolving Credit Agreement, are provided by a

geographically diverse group of over 20 major financial institutions based in countries including the United

States, Canada, France, Germany, Japan and the United Kingdom. No institution accounts for more than 9% of the

aggregate undrawn loan commitments under this agreement as of December 31, 2009.

Repayment and Termination of $2.0 Billion Term Facility

On March 17, 2009, the Company used a portion of the proceeds it received from the payment of the Special

Dividend to repay in full the $2.0 billion outstanding (plus accrued interest) under its unsecured term loan facility

with a maturity date of January 8, 2011 (the “Term Facility”) and terminated the Term Facility. Time Warner did not

incur any early termination or prepayment penalties in connection with the termination of the Term Facility.

Consent Solicitation

On April 15, 2009, the Company completed a solicitation of consents (the “Consent Solicitation”) from the

holders of the debt securities (the “Securities”) issued by Time Warner Inc. and its subsidiaries under all of the

indentures governing the publicly traded debt securities of the Company and its subsidiaries other than the indenture

entered into in November 2006 (other than the 2006 indenture, collectively, the “Indentures”). Completion of the

Consent Solicitation resulted in the adoption on April 16, 2009 of certain amendments to each Indenture that

provide that certain restrictive covenants will not apply (subject to the concurrent or prior issuance of the guarantee

by HBO discussed below) to a conveyance or transfer by Historic AOL LLC of its properties and assets substantially

as an entirety, unless such conveyance or transfer constitutes a conveyance or transfer of the properties and assets of

the issuer and the guarantors under the relevant Indenture and their respective subsidiaries, taken as a whole,

substantially as an entirety. In connection with the AOL Separation, on December 3, 2009, HBO issued a guarantee

of the obligations of Historic TW Inc. (“Historic TW”) (including in its capacity as successor to Time Warner

Companies, Inc.), whether as issuer or guarantor, under the Indentures and the Securities.

Other Financing Arrangements

From time to time, the Company enters into various other financing arrangements that provide for the

accelerated receipt of cash on certain accounts receivable. The Company employs these arrangements because they

have historically provided a cost-efficient form of financing, as well as an added level of diversification of funding

sources. For more details, see Note 7 to the accompanying consolidated financial statements.

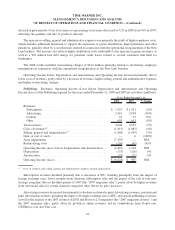

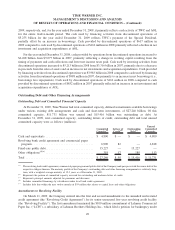

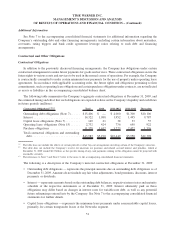

The following table summarizes the Company’s other financing arrangements at December 31, 2009 (millions):

Committed Capacity

(a)

Outstanding Utilization Unused Capacity

Accounts receivable securitization

facilities

(b)

.................... $ 805 $ 805 $ —

(a)

Ability to use accounts receivable securitization facilities depends on availability of qualified assets.

(b)

For the year ended December 31, 2009, the accounts receivable securitization facilities were accounted for as sales and, accordingly, the

accounts receivable sold under these facilities were excluded from receivables in the accompanying consolidated balance sheet. See

“Description of Business, Basis of Presentation and Summary of Significant Accounting Policies — Recent Accounting Guidance Not Yet

Adopted” in the accompanying notes to the consolidated financial statements for a description of amendments to the guidance to accounting

for transfers of financial assets, which became effective for Time Warner on January 1, 2010 and will be applied on a restrospective basis

beginning in the first quarter of 2010.

50

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)