Time Magazine 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.OVERVIEW

Time Warner is a leading media and entertainment company, whose major businesses encompass an array of the

most respected and successful media brands. Among the Company’s brands are HBO, TNT, CNN, People,Sports

Illustrated and Time. The Company produces and distributes films through Warner Bros. and New Line Cinema,

including Harry Potter and the Half-Blood Prince,The Hangover,The Blind Side and Sherlock Holmes, as well as

television series, including Two and a Half Men,The Mentalist,The Big Bang Theory,Gossip Girl and The Closer.

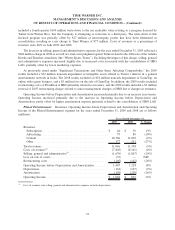

During 2009, the Company generated revenues of $25.785 billion (down 3% from $26.516 billion in 2008),

Operating Income of $4.545 billion (compared to Operating Loss of $3.028 billion in 2008), Net Income

attributable to Time Warner shareholders of $2.468 billion (compared to Net Loss attributable to Time Warner

shareholders of $13.402 billion in 2008) and Cash Provided by Operations from Continuing Operations of

$3.385 billion (down 17% from $4.064 billion in 2008). As discussed more fully in “Business Segment Results,” the

year ended December 31, 2008 included asset impairments of $7.213 billion, primarily related to reductions in the

carrying values of goodwill and identifiable intangible assets at the Company’s Publishing segment.

On March 12, 2009, the Company completed the legal and structural separation of Time Warner Cable Inc.

(“TWC”) from the Company. In addition, on December 9, 2009, the Company completed the legal and structural

separation of AOL Inc. (“AOL”) from the Company. With the completion of these separations, the Company

disposed of its Cable and AOL segments in their entirety and ceased to consolidate their financial condition and

results of operations in its consolidated financial statements. Accordingly, the Company has presented the financial

condition and results of operations of its former Cable and AOL segments as discontinued operations in the

accompanying consolidated financial statements for all periods presented.

Time Warner Businesses

Time Warner classifies its operations into three reportable segments: Networks, Filmed Entertainment and

Publishing.

Time Warner evaluates the performance and operational strength of its business segments based on several

factors, of which the primary financial measure is operating income before depreciation of tangible assets and

amortization of intangible assets (“Operating Income before Depreciation and Amortization”). Operating Income

before Depreciation and Amortization eliminates the uneven effects across all business segments of noncash

depreciation of tangible assets and amortization of certain intangible assets, primarily intangible assets recognized

in business combinations. Operating Income before Depreciation and Amortization should be considered in

addition to Operating Income, as well as other measures of financial performance. Accordingly, the discussion of

the results of operations for each of Time Warner’s business segments includes both Operating Income before

Depreciation and Amortization and Operating Income. For additional information regarding Time Warner’s

business segments, refer to Note 14, “Segment Information” to the accompanying consolidated financial

statements.

Networks. Time Warner’s Networks segment is comprised of Turner Broadcasting System, Inc. (“Turner”)

and Home Box Office, Inc. (“HBO”). In 2009, the Networks segment generated revenues of $11.703 billion (45% of

the Company’s overall revenues), $3.967 billion in Operating Income before Depreciation and Amortization and

$3.545 billion in Operating Income.

The Turner networks — including such recognized brands as TNT, TBS, CNN, Cartoon Network, truTV and

HLN — are among the leaders in advertising-supported cable television networks. For eight consecutive years,

more primetime households have watched advertising-supported cable television networks than the national

broadcast networks. The Turner networks generate revenues principally from providing programming to cable

system operators, satellite distribution services, telephone companies and other distributors (known as affiliates)

that have contracted to receive and distribute this programming and from the sale of advertising. Key contributors to

Turner’s success are its continued investments in high-quality, popular programming focused on sports, original and

22

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)