Time Magazine 2009 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

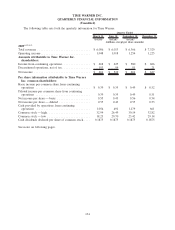

March 31, June 30, September 30, December 31,

Quarter Ended

(recast, millions, except per share amounts)

2008

(b)(c)(d)(e)

Total revenues ................................ $ 6,356 $ 6,421 $ 6,578 $ 7,161

Operating income (loss) ......................... 1,027 977 1,280 (6,312)

Amounts attributable to Time Warner Inc.

shareholders:

Income (loss) from continuing operations ............ $ 384 $ 414 $ 631 $ (6,523)

Discontinued operations, net of tax ................. 387 378 436 (9,509)

Net income (loss) .............................. $ 771 $ 792 $ 1,067 $(16,032)

Per share information attributable to Time Warner

Inc. common shareholders:

Basic income (loss) per common share from continuing

operations ................................. $ 0.32 $ 0.35 $ 0.53 $ (5.46)

Diluted income (loss) per common share from continuing

operations ................................. 0.32 0.34 0.52 (5.46)

Net income (loss) per share — basic ................ 0.65 0.66 0.89 (13.41)

Net income (loss) per share — diluted............... 0.64 0.66 0.89 (13.41)

Cash provided by operations from continuing

operations ................................. 1,348 598 1,528 590

Common stock — high .......................... 50.61 49.89 50.10 39.54

Common stock — low .......................... 40.95 42.06 38.04 21.21

Cash dividends declared per share of common stock .... 0.1875 0.1875 0.1875 0.1875

(a)

Time Warner’s operating income (loss) per common share in 2009 was affected by certain significant transactions and other items affecting

comparability. These items consisted of (i) a $33 million loss on the sale of Warner Bros.’ Italian cinema assets in the third quarter; (ii) a

$52 million noncash impairment of intangible assets related to Turner’s interest in a general entertainment network in India in the third

quarter and a $33 million noncash impairment of certain fixed assets at the Publishing segment in the fourth quarter; (iii) the following net

restructuring costs: $36 million during the first quarter, $27 million during the second quarter, $29 million during the third quarter and

$120 million during the fourth quarter (Note 12); and (iv) $7 million in net expenses related to securities litigation and government

investigations in each of the first, second and third quarters and $9 million in net expenses related to securities litigation and government

investigations in the fourth quarter.

(b)

The per share information attributable to Time Warner Inc. common shareholders reflects the 1-for-3 reverse stock split of the Company’s

common stock that became effective on March 27, 2009. Per common share amounts for the quarters and full years have each been

calculated separately. Accordingly, quarterly amounts may not add to the annual amounts because of differences in the average common

shares outstanding during each period and, with regard to diluted per common share amounts only, because of the inclusion of the effect of

potentially dilutive securities only in the periods in which such effect would have been dilutive.

(c)

Time Warner’s operating income (loss) per common share in 2008 was affected by certain significant transactions and other items affecting

comparability. These items consisted of (i) an $18 million noncash impairment of GameTap, an online video game business, during the

second quarter, a $30 million noncash asset impairment related to the sub-lease with a tenant that filed for bankruptcy in September 2008

during the third quarter, a $7.139 billion noncash impairment to reduce the carrying value of goodwill and intangible assets at the Publishing

segment, a $21 million noncash impairment of Southern Living At Home, which was sold in the third quarter of 2009, and a $5 million

noncash impairment related to certain other asset write-offs during the fourth quarter; (ii) the following net restructuring costs: $133 million

during the first quarter, $2 million during the second quarter, $18 million during the third quarter and $174 million during the fourth quarter

(Note 12); (iii) net losses from the disposal of consolidated assets of $3 million in the third quarter; and (iv) $4 million in net expenses

related to securities litigation and government investigations in both the first and second quarters, $5 million in net expenses related to

securities litigation and government investigations in the third quarter and $8 million in net expenses related to securities litigation and

government investigations in the fourth quarter.

(d)

As a result of the legal and structural separation of AOL Inc., the Company has presented the financial condition and results of operations of

its former AOL segment as discontinued operations for all periods. In 2009, this resulted in (i) a reduction of revenues of $859 million in the

first quarter, $796 million in the second quarter and $769 million in the third quarter; (ii) a decrease in operating income of $150 million in

the first quarter, $165 million in the second quarter and $134 million in the third quarter; and (iii) a decrease in income from continuing

135

TIME WARNER INC.

QUARTERLY FINANCIAL INFORMATION – (Continued)

(Unaudited)