Time Magazine 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

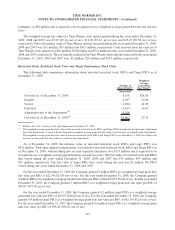

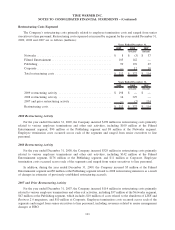

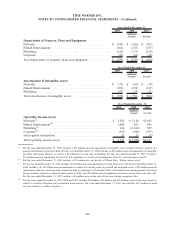

The following is a summary of amounts pertaining to Time Warner’s use of foreign currency derivatives at

December 31, 2009 (millions):

December 31,

2009

Qualifying Hedges

Assets ............................................................ $ 90

Liabilities .......................................................... (137)

Economic Hedges

Assets ............................................................ $ 7

Liabilities .......................................................... (43)

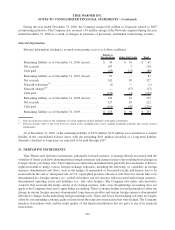

Netting provisions are provided for in existing International Swap and Derivative Association Inc. agreements

in situations where the Company executes multiple contracts with the same counterparty. As a result, net assets or

liabilities resulting from foreign exchange derivatives subject to these netting agreements are classified within

prepaid expenses and other current assets or accounts payable and accrued expenses in the Company’s consolidated

balance sheet. At December 31, 2009, $61 million of losses related to cash flow hedges are recorded in accumulated

other comprehensive income in the Company’s consolidated balance sheet and are expected to be recognized in

earnings at the same time hedged items affect earnings. Included in this amount are deferred net losses of

$17 million related to hedges of cash flows associated with films that are not expected to be released within the next

twelve months.

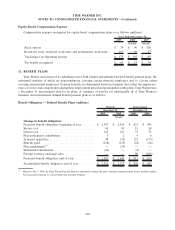

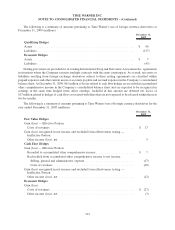

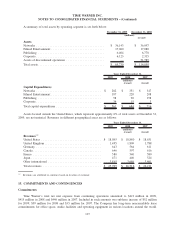

The following is a summary of amounts pertaining to Time Warner’s use of foreign currency derivatives for the

year ended December 31, 2009 (millions):

December 31,

2009

Fair Value Hedges

Gain (loss) — Effective Portion:

Costs of revenues .................................................. $ 17

Gain (loss) recognized in net income and excluded from effectiveness testing —

Ineffective Portion:

Other income (loss), net ............................................. 5

Cash Flow Hedges

Gain (loss) — Effective Portion:

Recorded to accumulated other comprehensive income ....................... $ 7

Reclassified from accumulated other comprehensive income to net income:

Selling, general and administrative expense ............................. (17)

Costs of revenues ................................................ (40)

Gain (loss) recognized in net income and excluded from effectiveness testing —

Ineffective Portion:

Other income (loss), net ............................................. (12)

Economic Hedges

Gain (loss):

Costs of revenues .................................................. $ (27)

Other income (loss), net ............................................. (3)

113

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)