Time Magazine 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

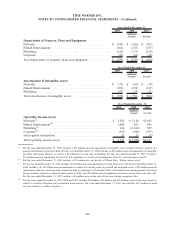

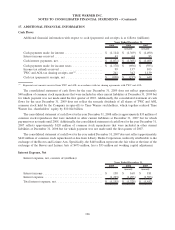

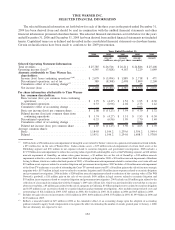

17. ADDITIONAL FINANCIAL INFORMATION

Cash Flows

Additional financial information with respect to cash (payments) and receipts is as follows (millions):

2009 2008 2007

Years Ended December 31,

(recast) (recast)

Cash payments made for interest ....................... $ (1,114) $ (1,369) $ (1,490)

Interest income received ............................. 43 64 85

Cash interest payments, net ........................... $ (1,071) $ (1,305) $ (1,405)

Cash payments made for income taxes .................. $ (1,178) $ (696) $ (593)

Income tax refunds received .......................... 99 137 103

TWC and AOL tax sharing receipts, net

(a)

................ 241 342 1,139

Cash tax (payments) receipts, net ...................... $ (838) $ (217) $ 649

(a)

Represents net amounts received from TWC and AOL in accordance with tax sharing agreements with TWC and AOL.

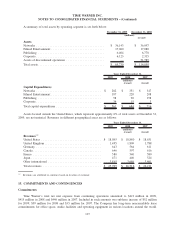

The consolidated statement of cash flows for the year December 31, 2009 does not reflect approximately

$40 million of common stock repurchases that were included in other current liabilities at December 31, 2009 but

for which payment was not made until the first quarter of 2010. Additionally, the consolidated statement of cash

flows for the year December 31, 2009 does not reflect the noncash dividends of all shares of TWC and AOL

common stock held by the Company in spin-offs to Time Warner stockholders, which together reduced Time

Warner Inc. shareholders’ equity by $10.024 billion.

The consolidated statement of cash flows for the year December 31, 2008 reflects approximately $33 million of

common stock repurchases that were included in other current liabilities at December 31, 2007 but for which

payment was not made until 2008. Additionally, the consolidated statement of cash flows for the year December 31,

2007 reflects approximately $120 million of common stock repurchases that were included in other current

liabilities at December 31, 2006 but for which payment was not made until the first quarter of 2007.

The consolidated statement of cash flows for the year ended December 31, 2007 does not reflect approximately

$440 million of common stock repurchased or due from Liberty Media Corporation, indirectly attributable to the

exchange of the Braves and Leisure Arts. Specifically, the $440 million represents the fair value at the time of the

exchange of the Braves and Leisure Arts of $473 million, less a $33 million net working capital adjustment.

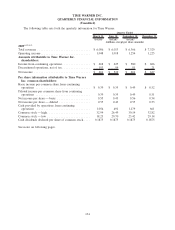

Interest Expense, Net

Interest expense, net, consists of (millions):

2009 2008 2007

Years Ended December 31,

(recast) (recast)

Interest income .................................... $ 138 $ 168 $ 181

Interest expense ................................... (1,293) (1,493) (1,593)

Total interest expense, net ............................ $ (1,155) $ (1,325) $ (1,412)

126

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)