Time Magazine 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

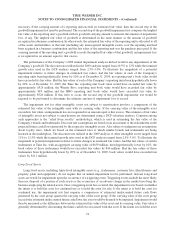

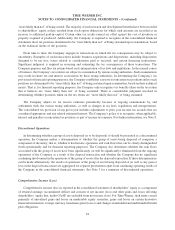

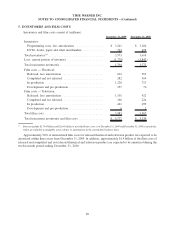

The following summary of changes in the Company’s goodwill related to continuing operations during the

years ended December 31, 2009 and 2008, by reportable segment, is as follows (millions):

December 31,

2007

Acquisitions,

Dispositions and

Adjustments

(a)

Impairments

Translation

Adjustments

December 31,

2008

Acquisitions,

Dispositions

and

Adjustments

(a)

Translation

Adjustments

December 31,

2009

(recast) (recast)

Networks

Gross goodwill. . . $ 34,352 $ 606 $ — $ 4 $ 34,962 $ (492) $ 5 $ 34,475

Impairments . . . . (13,277) — — — (13,277) — — (13,277)

Net goodwill . . . . 21,075 606 — 4 21,685 (492) 5 21,198

Filmed

Entertainment

Gross goodwill. . . 9,551 (14) — (4) 9,533 (19) 3 9,517

Impairments . . . . (4,091) — — — (4,091) — — (4,091)

Net goodwill . . . . 5,460 (14) — (4) 5,442 (19) 3 5,426

Publishing

Gross goodwill. . . 18,851 98 — (521) 18,428 (8) 39 18,459

Impairments . . . . (9,281) — (6,007) — (15,288) — — (15,288)

Net goodwill . . . . 9,570 98 (6,007) (521) 3,140 (8) 39 3,171

Time Warner

Gross goodwill. . . 62,754 690 — (521) 62,923 (519) 47 62,451

Impairments . . . . (26,649) — (6,007) — (32,656) — — (32,656)

Net goodwill . . . . $ 36,105 $ 690 $ (6,007) $ (521) $ 30,267 $ (519) $ 47 $ 29,795

(a)

2009 includes $481 million related to allocations of the final purchase price adjustments related to HBO LAG at the Networks segment.

2008 includes $612 million related to the acquisitions of additional interests in HBO LAG at the Networks segment as well as $60 million

related to the acquisition of QSP, Inc. and its Canadian affiliate Quality Service Programs Inc. (collectively, “QSP”) and $8 million related

to the acquisition of Mousebreaker at the Publishing segment.

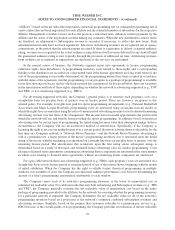

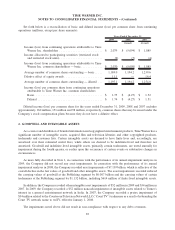

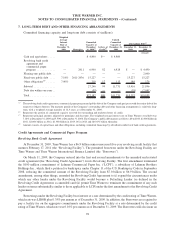

The Company’s intangible assets and related accumulated amortization consisted of the following (millions):

Gross

Accumulated

Amortization

(a)

Net Gross

Accumulated

Amortization

(a)

Net

December 31, 2009 December 31, 2008

(recast)

Intangible assets subject to amortization:

Film Library

(b)

. . . . . . . . . . . . . . . . . . $ 3,635 $ (1,871) $ 1,764 $ 3,861 $ (1,701) $ 2,160

Brands, trademarks and other intangible

assets

(c)

. . . . . . . . . . . . . . . . . . . . . . 2,275 (971) 1,304 1,912 (877) 1,035

Total . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,910 $ (2,842) $ 3,068 $ 5,773 $ (2,578) $ 3,195

Intangible assets not subject to

amortization:

Brands, trademarks and other intangible

assets

(c)

. . . . . . . . . . . . . . . . . . . . . . $ 8,093 $ (257) $ 7,836 $ 7,985 $ (257) $ 7,728

(a)

The Film Library is amortized using a film forecast methodology. Amortization of Brands, trademarks and other intangible assets subject to

amortization is provided generally on a straight-line basis over their respective useful lives. The weighted-average useful life for such

intangibles is 17 years. The Company evaluates the useful lives of its finite-lived intangible assets each reporting period to determine

whether events or circumstances warrant revised estimates of useful lives.

(b)

The decrease in 2009 is primarily related to an adjustment of $226 million representing a change in cumulative participations payable with

respect to film library titles at Warner Bros., which is required to be recognized as a reduction to the related film cost asset.

(c)

The increase in 2009 is primarily related to intangible assets recognized for HBO LAG.

84

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)