Time Magazine 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recent Accounting Guidance

See Note 1 to the accompanying consolidated financial statements for a discussion of accounting guidance

adopted in 2009 and recent accounting guidance not yet adopted.

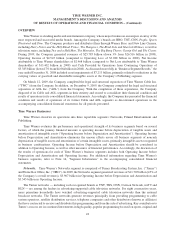

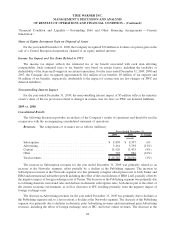

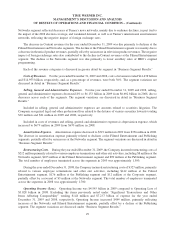

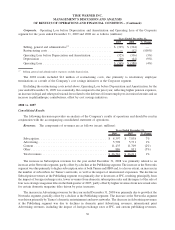

Significant Transactions and Other Items Affecting Comparability

As more fully described herein and in the related notes to the accompanying consolidated financial statements,

the comparability of Time Warner’s results from continuing operations has been affected by significant transactions

and certain other items in each period as follows (millions):

2009 2008 2007

Years Ended December 31,

(recast) (recast)

Amounts related to securities litigation and government investigations,

net .................................................. $ (30) $ (21) $ (171)

Asset impairments ......................................... (85) (7,213) (34)

Gain (loss) on sale of assets.................................. (33) (3) 6

Impact on Operating Income ................................. (148) (7,237) (199)

Investment gains (losses), net................................. (21) (60) 75

Amounts related to the separation of TWC....................... 14 (11) —

Costs related to the separation of AOL.......................... (15) — —

Share of equity investment gain on disposal of assets ............... — 30 —

Pretax impact ............................................ (170) (7,278) (124)

Income tax impact of above items . . ........................... 37 488 17

Tax items related to TWC ................................... 24 (9) 6

After-tax impact .......................................... (109) (6,799) (101)

Noncontrolling interest impact ................................ 5 — —

Impact of items on income from continuing operations attributable to

Time Warner Inc. shareholders . . . ........................... $ (104) $ (6,799) $ (101)

In addition to the items affecting comparability above, the Company incurred restructuring costs of

$212 million, $327 million and $114 million for the years ended December 31, 2009, 2008 and 2007,

respectively. For further discussions of restructuring costs, refer to the “Consolidated Results” and “Business

Segment Results” discussions.

Amounts Related to Securities Litigation

The Company recognized legal reserves as well as legal and other professional fees related to the defense of

various securities litigation totaling $30 million, $21 million and $180 million for the years ended December 31,

2009, 2008 and 2007 respectively. In addition, the Company recognized insurance recoveries of $9 million in 2007.

Asset Impairments

During the year ended December 31, 2009, the Company recorded noncash impairments of $52 million at the

Networks segment related to Turner’s interest in a general entertainment network in India and $33 million at the

Publishing segment related to certain fixed assets in connection with the Publishing segment’s restructuring

activities.

During the year ended December 31, 2008, the Company recorded noncash impairments related to goodwill

and identifiable intangible assets of $7.139 billion at the Publishing segment. The Company also recorded noncash

26

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)