Time Magazine 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

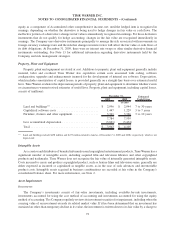

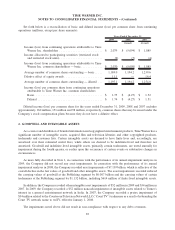

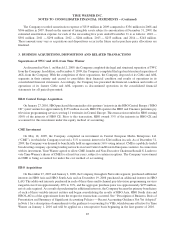

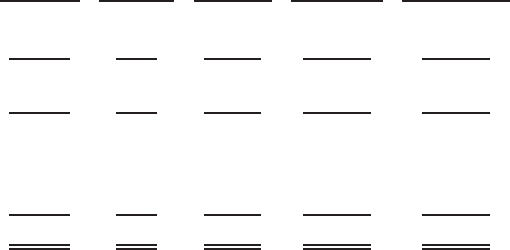

The following summary sets forth the components of other comprehensive income (loss), net of tax, for Time

Warner shareholders accumulated in equity (millions):

Foreign

Currency

Translation

Gains

(Losses)

Net

Unrealized

Gains

(Losses)

on

Securities

Net

Derivative

Financial

Instrument

Gains

(Losses)

Net

Unfunded/

Underfunded

Benefit

Obligation

Net

Accumulated

Other

Comprehensive

Income

(Loss)

Balance at December 31, 2006..... $ 306 $ 39 $ (2) $ (479) $ (136)

2007 activity .................. 290 — (7) 2 285

Balance at December 31, 2007..... 596 39 (9) (477) 149

2008 activity .................. (956) (18) (71) (780) (1,825)

Balance at December 31, 2008..... (360) 21 (80) (1,257) (1,676)

AOL Separation................ 278 — — — 278

Time Warner Cable Separation..... — — 4 387 391

2009 activity .................. 221 (12) 35 183 427

Balance at December 31, 2009..... $ 139 $ 9 $ (41) $ (687) $ (580)

For the years ended December 31, 2009 and 2008, the tax impact related to net unrealized gains (losses) on

securities was $7 million and $11 million, respectively. For the years ended December 31, 2009, 2008 and 2007, the

tax impact related to net derivative financial instrument gains (losses) was $21 million, $44 million and $4 million,

respectively. For the years ended December 31, 2009, 2008 and 2007, the tax impact related to net unfunded/

underfunded benefit obligations was $129 million, $515 million and $14 million, respectively.

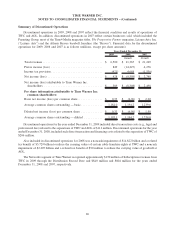

Income (Loss) Per Common Share

Basic income (loss) per common share is determined using the Two-Class Method and is computed by dividing

net income (loss) attributable to Time Warner Inc. common shareholders by the weighted-average common shares

outstanding during the period. The Two-Class Method is an earnings allocation formula that determines income

(loss) per share for each class of common stock and participating security according to dividends declared and

participation rights in undistributed earnings. Diluted income (loss) per common share reflects the more dilutive

earnings per share amount calculated using the treasury stock method or the Two-Class Method.

82

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)