Time Magazine 2009 Annual Report Download - page 77

Download and view the complete annual report

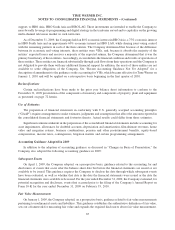

Please find page 77 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Description of Business

Time Warner Inc. (“Time Warner” or the “Company”) is a leading media and entertainment company, whose

businesses include television networks, filmed entertainment and publishing. Time Warner classifies its operations

into three reportable segments: Networks: consisting principally of cable television networks that provide

programming; Filmed Entertainment: consisting principally of feature film, television and home video

production and distribution; and Publishing: consisting principally of magazine publishing. Financial

information for Time Warner’s various reportable segments is presented in Note 14.

Changes in Basis of Presentation

The 2008 and 2007 financial information has been recast so that the basis of presentation is consistent with that

of the 2009 financial information. This recast reflects (i) the financial condition and results of operations of Time

Warner Cable Inc. (“TWC”) and AOL Inc. (“AOL”) as discontinued operations for all periods presented, (ii) the

adoption of recent accounting guidance pertaining to noncontrolling interests, (iii) the adoption of recent

accounting guidance pertaining to participating securities and (iv) the 1-for-3 reverse stock split of the

Company’s common stock that became effective on March 27, 2009.

AOL Separation from Time Warner

On July 8, 2009, the Company repurchased Google Inc.’s (“Google”) 5% interest in AOL for $283 million in

cash, which amount included a payment in respect of Google’s pro rata share of cash distributions to Time Warner

by AOL attributable to the period of Google’s investment in AOL. After repurchasing this stake, Time Warner

owned 100% of AOL.

On December 9, 2009 (the “Distribution Date”), the Company disposed of all of its shares of AOL common

stock. The disposition was made pursuant to a separation and distribution agreement entered into on November 16,

2009 by Time Warner and AOL for the purpose of legally and structurally separating AOL from Time Warner (the

“AOL Separation”). The AOL Separation was effected as a pro rata dividend of all shares of AOL common stock

held by Time Warner in a spin-off to Time Warner stockholders.

With the completion of the AOL Separation, the Company disposed of its AOL segment in its entirety.

Accordingly, the Company has presented the financial condition and results of operations of its former AOL

segment as discontinued operations in the consolidated financial statements for all periods presented. For a

summary of discontinued operations, see Note 3.

TWC Separation from Time Warner

On March 12, 2009 (the “Distribution Record Date”), the Company disposed of all of its shares of TWC

common stock. The disposition was made pursuant to a separation agreement entered into on May 20, 2008, among

Time Warner, TWC and certain of their subsidiaries (the “Separation Agreement”) for the purpose of legally and

structurally separating TWC from Time Warner (the “TWC Separation”). The TWC Separation was effected as a

pro rata dividend of all shares of TWC common stock held by Time Warner in a spin-off to Time Warner

stockholders.

Prior to the Distribution Record Date, on March 12, 2009, TWC, in accordance with the terms of the Separation

Agreement, paid a special cash dividend of $10.27 per share to all holders of TWC Class A common stock and TWC

Class B common stock as of the close of business on March 11, 2009 (aggregating $10.856 billion) (the “Special

Dividend”), which resulted in the receipt by Time Warner of $9.253 billion.

65