Time Magazine 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

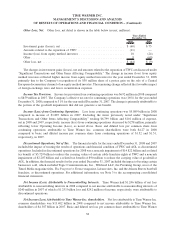

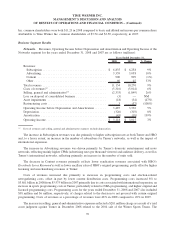

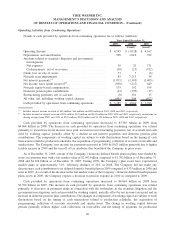

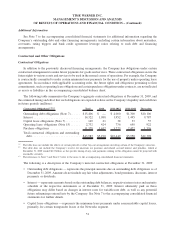

The following table shows the significant items contributing to the decrease in consolidated net debt from

December 31, 2008 to December 31, 2009 (millions):

Balance at December 31, 2008 ............................................. $ 20,797

Cash provided by operations from continuing operations .......................... (3,385)

Cash provided by discontinued operations ..................................... (617)

Capital expenditures ..................................................... 561

Dividends paid to common stockholders ...................................... 897

Investments and acquisitions, net

(a)

.......................................... 749

Proceeds from the sale of investments

(a)

...................................... (299)

Repurchases of common stock

(b)

............................................ 1,158

Proceeds from the Special Dividend

(a)

........................................ (9,253)

All other, net .......................................................... 8

Balance at December 31, 2009

(c)

............................................ $ 10,616

(a)

Refer to “Investing Activities” below for further detail.

(b)

Refer to “Financing Activities” below for further detail.

(c)

Included in the net debt balance is $20 million that represents the unamortized fair value adjustment recognized as a result of the merger of

AOL and Historic TW Inc.

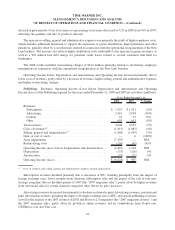

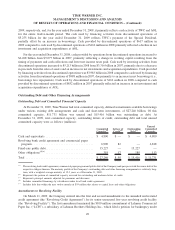

As noted in “Recent Developments,” on July 26, 2007, Time Warner’s Board of Directors authorized a common

stock repurchase program that allows the Company to purchase up to an aggregate of $5 billion of common stock.

Purchases under this stock repurchase program may be made from time to time on the open market and in privately

negotiated transactions. The size and timing of these purchases are based on a number of factors, including price and

business and market conditions. From the program’s inception through February 17, 2010, the Company

repurchased approximately 102 million shares of common stock for approximately $4.2 billion pursuant to

trading programs under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended. This number included

approximately 51 million shares of common stock purchased for approximately $1.4 billion in 2009 (Note 9). As of

December 31, 2009, the Company had approximately $1.0 billion remaining on its stock repurchase program. On

January 28, 2010, Time Warner’s Board of Directors increased this amount to $3.0 billion.

Time Warner’s $2.000 billion aggregate principal amount of floating rate public debt matured on November 13,

2009, and the Company paid such aggregate principal amount and the accrued interest in cash on the maturity date.

The Company does not have any other public debt maturing until April 2011.

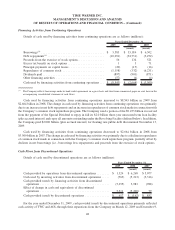

Cash Flows

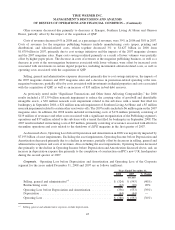

Cash and equivalents increased by $3.701 billion, including $617 million of cash provided by discontinued

operations, in 2009 and decreased by $34 million, including $162 million of cash used by discontinued operations,

in 2008. Components of these changes are discussed below in more detail.

45

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)