Time Magazine 2009 Annual Report Download - page 56

Download and view the complete annual report

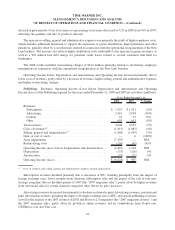

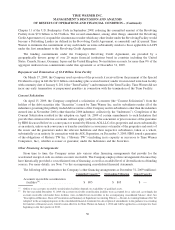

Please find page 56 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As previously noted, the Company recognized legal reserves as well as legal and other professional fees related

to the defense of various securities lawsuits, totaling $21 million in 2008 and $180 million in 2007. In addition, the

Company recognized related insurance recoveries of $9 million in 2007.

The 2008 and 2007 results included $12 million and $10 million of restructuring costs, respectively, due

primarily to involuntary employee terminations as a result of the Company’s cost savings initiatives at the Corporate

segment. These initiatives resulted in annual savings of more than $50 million.

Excluding the items noted above, Operating Loss before Depreciation and Amortization and Operating Loss

decreased due primarily to lower corporate costs, related primarily to the cost savings initiatives.

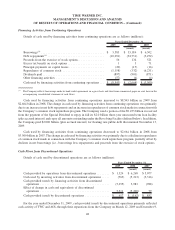

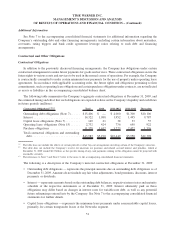

FINANCIAL CONDITION AND LIQUIDITY

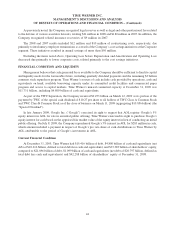

Management believes that cash generated by or available to the Company should be sufficient to fund its capital

and liquidity needs for the foreseeable future, including quarterly dividend payments and the remaining $3 billion

common stock repurchase program. Time Warner’s sources of cash include cash provided by operations, cash and

equivalents on hand, available borrowing capacity under its committed credit facilities and commercial paper

program and access to capital markets. Time Warner’s unused committed capacity at December 31, 2009 was

$11.731 billion, including $4.800 billion of cash and equivalents.

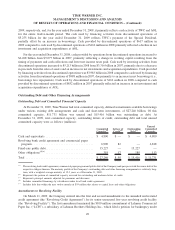

As part of the TWC Separation, the Company received $9.253 billion on March 12, 2009 as its portion of the

payment by TWC of the special cash dividend of $10.27 per share to all holders of TWC Class A Common Stock

and TWC Class B Common Stock as of the close of business on March 11, 2009 (aggregating $10.856 billion) (the

“Special Dividend”).

In late January 2009, Google Inc. (“Google”) exercised its right to request that AOL register Google’s 5%

equity interest in AOL for sale in an initial public offering. Time Warner exercised its right to purchase Google’s

equity interest for cash based on the appraised fair market value of the equity interest in lieu of conducting an initial

public offering. On July 8, 2009, the Company repurchased Google’s 5% interest in AOL for $283 million in cash,

which amount included a payment in respect of Google’s pro rata share of cash distributions to Time Warner by

AOL attributable to the period of Google’s investment in AOL.

Current Financial Condition

At December 31, 2009, Time Warner had $15.416 billion of debt, $4.800 billion of cash and equivalents (net

debt of $10.616 billion, defined as total debt less cash and equivalents) and $33.383 billion of shareholders’ equity,

compared to $21.896 billion of debt, $1.099 billion of cash and equivalents (net debt of $20.797 billion, defined as

total debt less cash and equivalents) and $42.288 billion of shareholders’ equity at December 31, 2008.

44

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)