Time Magazine 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

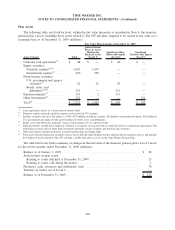

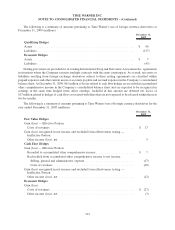

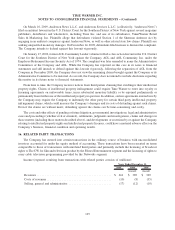

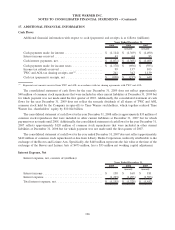

2009 2008 2007

Years Ended December 31,

(millions)

(recast) (recast)

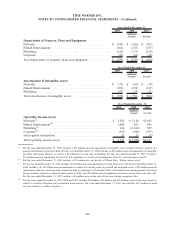

Depreciation of Property, Plant and Equipment

Networks . . .......................................... $ (349) $ (326) $ (303)

Filmed Entertainment ................................... (164) (167) (153)

Publishing . .......................................... (126) (133) (126)

Corporate . . .......................................... (40) (44) (44)

Total depreciation of property, plant and equipment ............. $ (679) $ (670) $ (626)

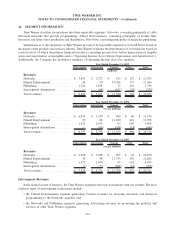

2009 2008 2007

Years Ended December 31,

(millions)

(recast) (recast)

Amortization of Intangible Assets

Networks . . .......................................... $ (73) $ (43) $ (18)

Filmed Entertainment ................................... (199) (238) (217)

Publishing . .......................................... (47) (75) (71)

Total amortization of intangible assets ....................... $ (319) $ (356) $ (306)

2009 2008 2007

Years Ended December 31,

(millions)

(recast) (recast)

Operating Income (Loss)

Networks

(a)

........................................... $ 3,545 $ 3,118 $3,015

Filmed Entertainment

(b)

.................................. 1,084 823 845

Publishing

(c)

.......................................... 246 (6,624) 907

Corporate

(d)

........................................... (365) (380) (597)

Intersegment eliminations................................. 35 35 (3)

Total operating income (loss) .............................. $ 4,545 $(3,028) $4,167

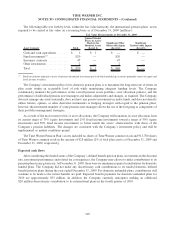

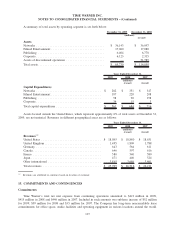

(a)

For the year ended December 31, 2009, includes a $52 million noncash impairment of intangible assets related to Turner’s interest in a

general entertainment network in India. For the year ended December 31, 2008, includes an $18 million noncash impairment of GameTap,

an online video game business, as well as a $3 million loss on the sale of GameTap. For the year ended December 31, 2007, includes a

$34 million noncash impairment of the Court TV tradename as a result of rebranding the Court TV network name to truTV.

(b)

For the year ended December 31, 2009, includes a $33 million loss on the sale of Warner Bros.’ Italian cinema assets.

(c)

For the year ended December 31, 2009, includes a $33 million noncash impairment of certain fixed assets. For the year ended December 31,

2008, includes a $7.139 billion noncash impairment to reduce the carrying value of goodwill and intangible assets, a $30 million noncash

impairment related to a sub-lease with a tenant that filed for bankruptcy in September 2008, a $21 million noncash impairment of Southern

Living At Home, which was sold in the third quarter of 2009, and a $5 million noncash impairment related to certain other asset write-offs.

For the year ended December 31, 2007, includes a $6 million gain on the sale of four non-strategic magazine titles.

(d)

For the years ended December 31, 2009, 2008 and 2007, includes $30 million, $21 million and $18 million, respectively in net expenses

related to securities litigation and government investigations. The year ended December 31, 2007 also includes $153 million in legal

reserves related to securities litigation.

116

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)