Time Magazine 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.support, to HBO Asia, HBO South Asia and HBO LAG. These investments are intended to enable the Company to

more broadly leverage its programming and digital strategy in the territories served and to capitalize on the growing

multi-channel television market in such territories.

As of December 31, 2009, the Company held an 80% economic interest in HBO Asia, a 75% economic interest

in HBO South Asia and an approximate 60% economic interest in HBO LAG, while sharing joint voting control

with the remaining partners in each of the three entities. The Company determined that because of the difference

between its economic and voting interests, these entities were VIEs, and, because it absorbs the majority of the

entities’ expected losses and receives a majority of the expected returns, the Company determined that it was the

primary beneficiary of these entities. Accordingly, it consolidates the financial condition and results of operations of

these entities. These entities are financed substantially through cash flows from their operations and the Company is

not obligated to provide them with any additional financial support. In addition, the assets of these entities are not

available to settle obligations of the Company. See “Recent Accounting Guidance Not Yet Adopted” for a

description of amendments to the guidance on the accounting for VIEs, which became effective for Time Warner on

January 1, 2010 and will be applied on a retrospective basis beginning in the first quarter of 2010.

Reclassifications

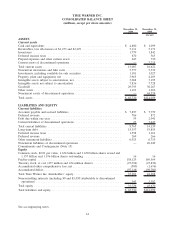

Certain reclassifications have been made to the prior year balance sheet information to conform to the

December 31, 2009 presentation of the components of inventory and components of property, plant and equipment

as presented on page 72 herein.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles

(“GAAP”) requires management to make estimates, judgments and assumptions that affect the amounts reported in

the consolidated financial statements and footnotes thereto. Actual results could differ from those estimates.

Significant estimates inherent in the preparation of the consolidated financial statements include accounting for

asset impairments, allowances for doubtful accounts, depreciation and amortization, film ultimate revenues, home

video and magazine returns, business combinations, pension and other postretirement benefits, equity-based

compensation, income taxes, contingencies, litigation matters and certain programming arrangements.

Accounting Guidance Adopted in 2009

In addition to the adoption of accounting guidance as discussed in “Changes in Basis of Presentation,” the

Company also adopted the following accounting guidance in 2009:

Subsequent Events

On April 1, 2009, the Company adopted, on a prospective basis, guidance related to the accounting for and

disclosures of events that occur after the balance sheet date but before the financial statements are issued or are

available to be issued. This guidance requires the Company to disclose the date through which subsequent events

have been evaluated, as well as whether that date is the date the financial statements were issued or the date the

financial statements were available to be issued. For the year ended December 31, 2009, the Company evaluated, for

potential recognition and disclosure, events that occurred prior to the filing of the Company’s Annual Report on

Form 10-K for the year ended December 31, 2009 on February 19, 2010.

Fair Value Measurements

On January 1, 2009, the Company adopted, on a prospective basis, guidance related to fair value measurements

pertaining to nonfinancial assets and liabilities. This guidance establishes the authoritative definition of fair value,

sets out a framework for measuring fair value and expands the required disclosures about fair value measurement.

67

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)