Time Magazine 2009 Annual Report Download - page 112

Download and view the complete annual report

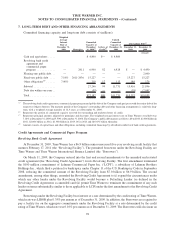

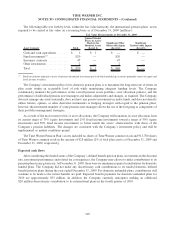

Please find page 112 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of the Securities Exchange Act of 1934, as amended. This number included approximately 43 million shares of

common stock purchased for approximately $1.2 billion during the year ended December 31, 2009. As of

December 31, 2009, the Company had approximately $1.0 billion remaining on its stock repurchase program. On

January 28, 2010, Time Warner’s Board of Directors increased this amount to $3.0 billion.

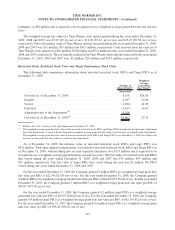

Shares Authorized and Outstanding

At December 31, 2009, shareholders’ equity of Time Warner included 1.157 billion shares of common stock

(net of approximately 477 million shares of common stock held in treasury). As of December 31, 2009, Time

Warner is authorized to issue up to 750 million shares of preferred stock, up to 8.333 billion shares of common stock

and up to 600 million shares of additional classes of common stock. At December 31, 2008, shareholders’ equity of

Time Warner included 1.196 billion of common stock (net of approximately 434 million shares of common stock

held in treasury).

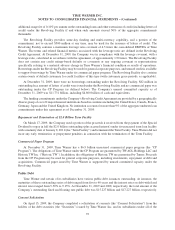

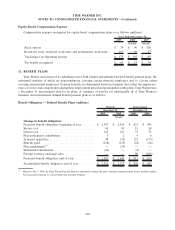

10. EQUITY-BASED COMPENSATION

Equity Plans

The Company has one active equity plan under which it is authorized to grant equity awards to employees and

non-employee directors, covering an aggregate of 72 million shares of common stock. Options have been granted to

employees and non-employee directors of Time Warner with exercise prices equal to, or in excess of, the fair market

value at the date of grant. Generally, the stock options vest ratably over a four-year vesting period and expire ten

years from the date of grant. Certain stock option awards provide for accelerated vesting upon an election to retire

pursuant to the Company’s defined benefit retirement plans or after reaching a specified age and years of service, as

well as certain additional circumstances for non-employee directors.

Pursuant to this equity plan, Time Warner may also grant shares of common stock or restricted stock units

(“RSUs”), which generally vest between three to five years from the date of grant, to its employees and non-

employee directors. Certain RSU awards provide for accelerated vesting upon an election to retire pursuant to the

Company’s defined benefit retirement plans or after reaching a specified age and years of service, as well as certain

additional circumstances for non-employee directors. Holders of restricted stock and RSU awards are generally

entitled to receive cash dividends or dividend equivalents, respectively, paid by the Company during the period of

time that the restricted stock or RSU awards are unvested.

Time Warner also has a performance stock unit program for senior level executives. Under this program,

recipients of performance stock units (“PSUs”) are awarded a target number of PSUs that represent the contingent

(unfunded and unsecured) right to receive shares of Company stock at the end of a performance period (generally

three years) based on the actual performance level achieved by the Company. For PSUs granted prior to 2009, the

recipient of a PSU may receive, depending on the Company’s total shareholder return (“TSR”) relative to the other

companies in the S&P 500 Index, 0% to 200% of the target PSUs granted based on a sliding scale where a relative

ranking of less than the 25th percentile will pay 0% and a ranking at the 100th percentile will pay 200% of the target

number of shares.

For PSUs granted in 2009, the recipient of a PSU may receive a percentage of target PSUs determined in the

same manner as PSUs granted prior to 2009, except if the Company’s TSR ranking is below the 50th percentile and

its growth in adjusted earnings per share (“adjusted EPS”) relative to the growth in adjusted EPS of the other

companies in the S&P 500 Index is at or above the 50th percentile. In such situations, the percentage of a

participant’s target PSUs that will vest will be the average of (i) the percentage of target PSUs that would vest based

on the Company’s TSR ranking during the performance period and (ii) 100%.

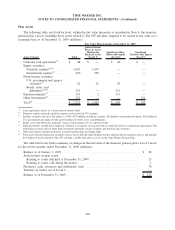

For accounting purposes, PSUs granted prior to 2009 are considered to have a market condition and PSUs

granted in 2009 are considered to have a market condition and a performance condition. The effect of a market

100

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)