Time Magazine 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

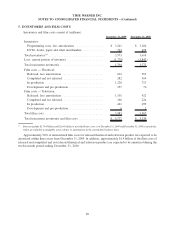

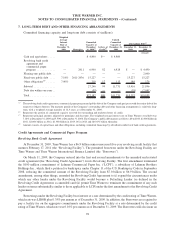

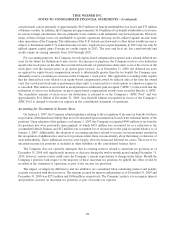

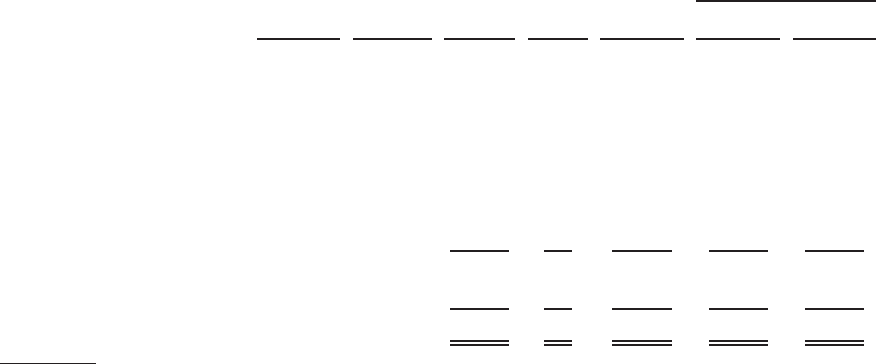

7. LONG-TERM DEBT AND OTHER FINANCING ARRANGEMENTS

Committed financing capacity and long-term debt consists of (millions):

Weighted

Average

Interest

Rate at

December 31,

2009 Maturities

Committed

Capacity at

December

31, 2009

(a)

Letters of

Credit

(b)

Unused

Committed

Capacity at

December 31,

2009

December 31,

2009

December 31,

2008

Outstanding Debt

(c)

(recast)

Cash and equivalents . . . . . $ 4,800 $— $ 4,800

Revolving bank credit

agreement and

commercial paper

program . . . . . . . . . . . . — 2011 6,900 82 6,818 $ — $ 4,490

Floating-rate public debt . . — — — — — — 2,000

Fixed-rate public debt . . . . 7.14% 2011-2036 15,227 — — 15,227 15,227

Other obligations

(d)

. . . . . . 7.00% 319 17 113 189 179

Subtotal . . . . . . . . . . . . . . 27,246 99 11,731 15,416 21,896

Debt due within one year . . (59) — — (59) (2,041)

Total . . . . . . . . . . . . . . . . $27,187 $99 $11,731 $15,357 $19,855

(a)

The revolving bank credit agreement, commercial paper program and public debt of the Company rank pari passu with the senior debt of the

respective obligors thereon. The maturity profile of the Company’s outstanding debt and other financing arrangements is relatively long-

term, with a weighted average maturity of 12.3 years as of December 31, 2009.

(b)

Represents the portion of committed capacity reserved for outstanding and undrawn letters of credit.

(c)

Represents principal amounts adjusted for premiums and discounts. The weighted-average interest rate on Time Warner’s total debt was

7.14% at December 31, 2009 and 5.50% at December 31, 2008. The Company’s public debt matures as follows: $0 in 2010, $2.000 billion in

2011, $2.000 billion in 2012, $1.300 billion in 2013, $0 in 2014 and $10.031 billion thereafter.

(d)

Amount consists of capital lease and other obligations, including committed financings by subsidiaries under local bank credit agreements.

Credit Agreements and Commercial Paper Program

Revolving Bank Credit Agreement

At December 31, 2009, Time Warner has a $6.9 billion senior unsecured five-year revolving credit facility that

matures February 17, 2011 (the “Revolving Facility”). The permitted borrowers under the Revolving Facility are

Time Warner and Time Warner International Finance Limited (the “Borrowers”).

On March 11, 2009, the Company entered into the first and second amendments to the amended and restated

credit agreement (the “Revolving Credit Agreement”) for its Revolving Facility. The first amendment terminated

the $100 million commitment of Lehman Commercial Paper Inc. (“LCPI”), a subsidiary of Lehman Brothers

Holdings Inc., which filed a petition for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code in September

2008, reducing the committed amount of the Revolving Facility from $7.0 billion to $6.9 billion. The second

amendment, among other things, amended the Revolving Credit Agreement to (i) expand the circumstances under

which any other lender under the Revolving Facility would become a Defaulting Lender (as defined in the

Revolving Credit Agreement, as amended) and (ii) permit Time Warner to terminate the commitment of any such

lender on terms substantially similar to those applicable to LCPI under the first amendment to the Revolving Credit

Agreement.

Borrowings under the Revolving Facility bear interest at a rate determined by the credit rating of Time Warner,

which rate was LIBOR plus 0.35% per annum as of December 31, 2009. In addition, the Borrowers are required to

pay a facility fee on the aggregate commitments under the Revolving Facility at a rate determined by the credit

rating of Time Warner, which rate was 0.10% per annum as of December 31, 2009. The Borrowers will also incur an

92

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)