Time Magazine 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

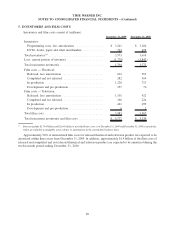

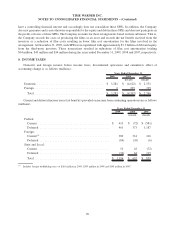

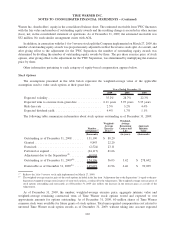

The differences between income taxes (tax benefits) expected at the U.S. federal statutory income tax rate of

35% and income taxes (tax benefits) provided are as set forth below (millions):

2009 2008 2007

Years Ended December 31,

(recast) (recast)

Taxes (tax benefits) on income at U.S. federal statutory rate ...... $ 1,149 $(1,539) $ 961

State and local taxes (tax benefits), net of federal tax effects...... 79 (99) 63

Nondeductible goodwill impairments ....................... — 2,208 —

Litigation matters ..................................... — 107 —

Valuation allowances ................................... 19 — (102)

Other .............................................. (53) 15 (63)

Total ............................................... $ 1,194 $ 692 $ 859

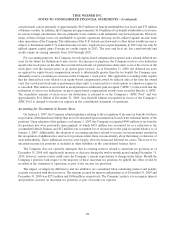

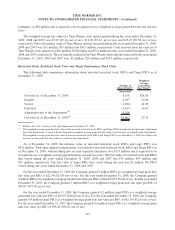

Significant components of Time Warner’s net deferred tax liabilities are as follows (millions):

2009 2008

December 31,

(recast)

Deferred tax assets:

Tax attribute carryforwards ..................................... $ 706 $ 587

Receivable allowances and return reserves .......................... 337 308

Royalties, participations and residuals . . ........................... 353 377

Investments ................................................. 208 299

Equity-based compensation ..................................... 1,187 1,282

Amortization and Depreciation .................................. 559 999

Other ..................................................... 1,287 1,568

Valuation allowances

(a)

........................................ (701) (788)

Total Deferred tax assets ..................................... $ 3,936 $ 4,632

Deferred tax liabilities:

Assets acquired in business combinations ........................... $ 3,821 $ 4,087

Unbilled television receivables ................................... 861 1,025

Unremitted earnings of foreign subsidiaries ......................... 182 116

Total Deferred tax liabilities ................................... 4,864 5,228

Net deferred tax liability

(b)

..................................... $ 928 $ 596

(a)

The Company has recorded valuation allowances for certain tax attributes and other deferred tax assets. As of December 31, 2009, sufficient

uncertainty exists regarding the future realization of these deferred tax assets. If in the future the Company believes that it is more likely than

not that these deferred tax benefits will be realized, the majority of the valuation allowances will be recognized in the statement of

operations.

(b)

The net deferred tax liability includes current deferred tax assets of $670 million and $565 million as of December 31, 2009 and 2008,

respectively.

U.S. income and foreign withholding taxes have not been recorded on permanently reinvested earnings of

certain foreign subsidiaries aggregating approximately $1.6 billion at December 31, 2009. Determination of the

amount of unrecognized deferred U.S. income tax liability with respect to such earnings is not practicable.

U.S. federal tax attribute carryforwards at December 31, 2009, consist primarily of approximately $85 million

of tax benefit attributable to tax losses and $244 million of foreign tax credits. U.S. state and local tax attribute

97

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)