Time Magazine 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additional Information

See Note 7 to the accompanying consolidated financial statements for additional information regarding the

Company’s outstanding debt and other financing arrangements, including certain information about maturities,

covenants, rating triggers and bank credit agreement leverage ratios relating to such debt and financing

arrangements.

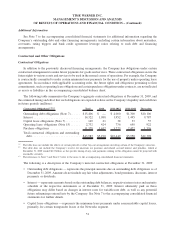

Contractual and Other Obligations

Contractual Obligations

In addition to the previously discussed financing arrangements, the Company has obligations under certain

contractual arrangements to make future payments for goods and services. These contractual obligations secure the

future rights to various assets and services to be used in the normal course of operations. For example, the Company

is contractually committed to make certain minimum lease payments for the use of property under operating lease

agreements. In accordance with applicable accounting rules, the future rights and obligations pertaining to firm

commitments, such as operating lease obligations and certain purchase obligations under contracts, are not reflected

as assets or liabilities in the accompanying consolidated balance sheet.

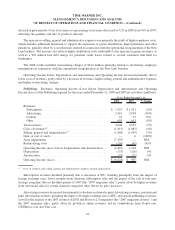

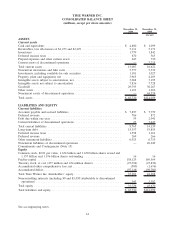

The following table summarizes the Company’s aggregate contractual obligations at December 31, 2009, and

the estimated timing and effect that such obligations are expected to have on the Company’s liquidity and cash flows

in future periods (millions):

Contractual Obligations

(a)(b)(c)

Total 2010 2011-2012 2013-2014 Thereafter

Outstanding debt obligations (Note 7)...... $15,406 $ — $ 4,000 $1,300 $10,106

Interest ............................ 14,322 1,088 1,952 1,495 9,787

Capital lease obligations (Note 7) ......... 149 21 38 33 57

Operating lease obligations (Note 15) ...... 2,732 424 736 650 922

Purchase obligations .................. 11,378 3,657 3,723 2,472 1,526

Total contractual obligations and outstanding

debt ............................. $43,987 $5,190 $10,449 $5,950 $22,398

(a)

The table does not include the effects of certain put/call or other buy-out arrangements involving certain of the Company’s investees.

(b)

The table does not include the Company’s reserve for uncertain tax positions and related accrued interest and penalties, which at

December 31, 2009 totaled $2.2 billion, as the specific timing of any cash payments relating to this obligation cannot be projected with

reasonable certainty.

(c)

The references to Note 7 and Note 15 refer to the notes to the accompanying consolidated financial statements.

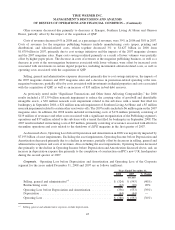

The following is a description of the Company’s material contractual obligations at December 31, 2009:

• Outstanding debt obligations — represents the principal amounts due on outstanding debt obligations as of

December 31, 2009. Amounts do not include any fair value adjustments, bond premiums, discounts, interest

payments or dividends.

• Interest — represents amounts based on the outstanding debt balances, respective interest rates and maturity

schedule of the respective instruments as of December 31, 2009. Interest ultimately paid on these

obligations may differ based on changes in interest rates for variable-rate debt, as well as any potential

future refinancings entered into by the Company. See Note 7 to the accompanying consolidated financial

statements for further details.

• Capital lease obligations — represents the minimum lease payments under noncancelable capital leases,

primarily for certain transponder leases at the Networks segment.

51

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)