Time Magazine 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

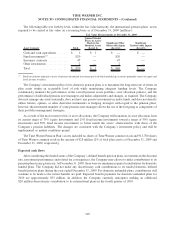

Warner Inc. shareholders’ equity in the consolidated balance sheet. The estimated receivable from TWC fluctuates

with the fair value and number of outstanding equity awards and the resulting change is recorded in other income

(loss), net, in the consolidated statement of operations. As of December 31, 2009, the estimated receivable was

$32 million. No such similar arrangement exists with AOL.

In addition, in connection with the 1-for-3 reverse stock split the Company implemented on March 27, 2009, the

number of outstanding equity awards was proportionately adjusted to reflect the reverse stock split. As a result, and

after giving effect to the adjustment for the TWC Separation, the number of outstanding equity awards was

determined by dividing the number of outstanding equity awards by three. The per share exercise price of stock

options, after giving effect to the adjustment for the TWC Separation, was determined by multiplying the exercise

price by three.

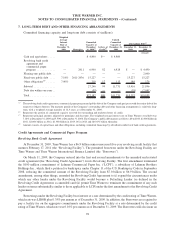

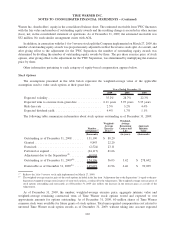

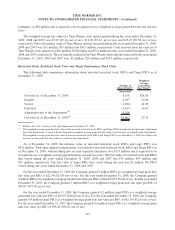

Other information pertaining to each category of equity-based compensation appears below.

Stock Options

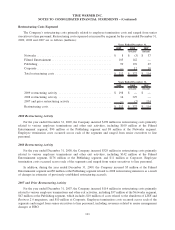

The assumptions presented in the table below represent the weighted-average value of the applicable

assumption used to value stock options at their grant date.

2009 2008 2007

Years Ended December 31,

Expected volatility................................ 35.2% 28.7% 22.3%

Expected term to exercise from grant date .............. 6.11 years 5.95 years 5.35 years

Risk-free rate ................................... 2.5% 3.2% 4.4%

Expected dividend yield............................ 4.4% 1.7% 1.1%

The following table summarizes information about stock options outstanding as of December 31, 2009:

Number

of Options

(a)

Weighted-

Average

Exercise

Price

(a)

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(thousands) (in years) (thousands)

Outstanding as of December 31, 2008 ...... 131,190 $ 88.20

Granted ............................. 9,843 22.20

Exercised............................ (2,524) 23.11

Forfeited or expired .................... (24,117) 81.66

Adjustment due to the Separations

(b)

........ 60,004

Outstanding as of December 31, 2009

(b)

..... 174,396 56.03 3.42 $ 278,692

Exercisable as of December 31, 2009

(b)

..... 145,619 61.96 2.46 $ 99,005

(a)

Reflects the 1-for-3 reverse stock split implemented on March 27, 2009.

(b)

The weighted-average exercise price of the stock options included in the line item “Adjustment due to the Separations” is equal to the pre-

Separation weighted-average exercise price of such stock options, as reduced by the Adjustments. The weighted-average exercise price of

stock options outstanding and exercisable as of December 31, 2009 also reflects the decrease in the exercise price as a result of the

Adjustments.

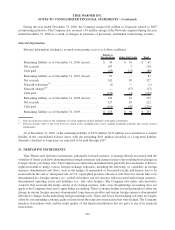

As of December 31, 2009, the number, weighted-average exercise price, aggregate intrinsic value and

weighted-average remaining contractual term of Time Warner stock options vested and expected to vest

approximate amounts for options outstanding. As of December 31, 2009, 60 million shares of Time Warner

common stock were available for future grants of stock options. Total unrecognized compensation cost related to

unvested Time Warner stock option awards as of December 31, 2009, without taking into account expected

102

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)